Introduction

Oil and gas companies are saving approximately $2.89 for every $1 they spend on EDI solutions.

That’s a remarkable return on investment that’s transforming how the petroleum industry handles its data. Electronic data interchange (EDI) has become a critical technology for streamlining operations across the energy sector. Sending a single paper document costs between $10-30, while an EDI transaction can cost as little as $1-2.

Additionally, the American Petroleum Institute estimated potential petroleum industry savings from EDI at more than $500 million per year. This explains why companies now use EDI for 35% of all their documents. The EDI benefits extend beyond just cost savings. EDI standards enable standardized data formats that facilitate easy communication between various industry stakeholders.

Furthermore, we’ve seen how EDI integration simplifies and accelerates operations by significantly reducing manual processes in data transmission. The results are impressive: more accurate billing, faster procurement, and better inventory management across the energy value chain.

Key Takeaways

Exceptional ROI for EDI Implementation: Oil and gas companies save approximately $2.89 for every $1 spent on EDI solutions, with potential industry-wide savings estimated at more than $500 million annually. Traditional paper documents cost between $10-30 each to process, whereas an EDI transaction can cost as little as $1-2, creating substantial operational cost reductions.

Dramatic Error Reduction Across Operations: Companies implementing EDI cut their overall error rates by an average of 85%—from 10.6% with paper documents to just 1.6% with EDI across all functions. This dramatic improvement occurs because EDI eliminates error-prone manual data entry processes and incorporates built-in validation rules that identify errors before processing.

Standardized Communication Throughout the Value Chain: The petroleum industry relies on specialized EDI standards like ANSI ASC X12, UN/EDIFACT, and NAESB, alongside industry-specific frameworks such as PIDX, CODE, and GRADE. These standards create a “unified language” for information exchange, ensuring critical data flows seamlessly between stakeholders throughout the complex oil and gas supply chain.

Enhanced Operational Efficiency: EDI reduces order processing times by up to 62%, transforming what previously took days with paper-based methods into matters of minutes. This acceleration enables real-time decision-making capabilities—a critical advantage in an industry where responsiveness significantly impacts profitability.

Future Evolution Through Integration: The industry is rapidly embracing cloud-based EDI platforms and integrating AI capabilities for enhanced document validation, intelligent matching, and predictive analytics. These technological advancements will transform how oil and gas companies manage data, make decisions, and comply with regulatory requirements in increasingly complex operational environments.

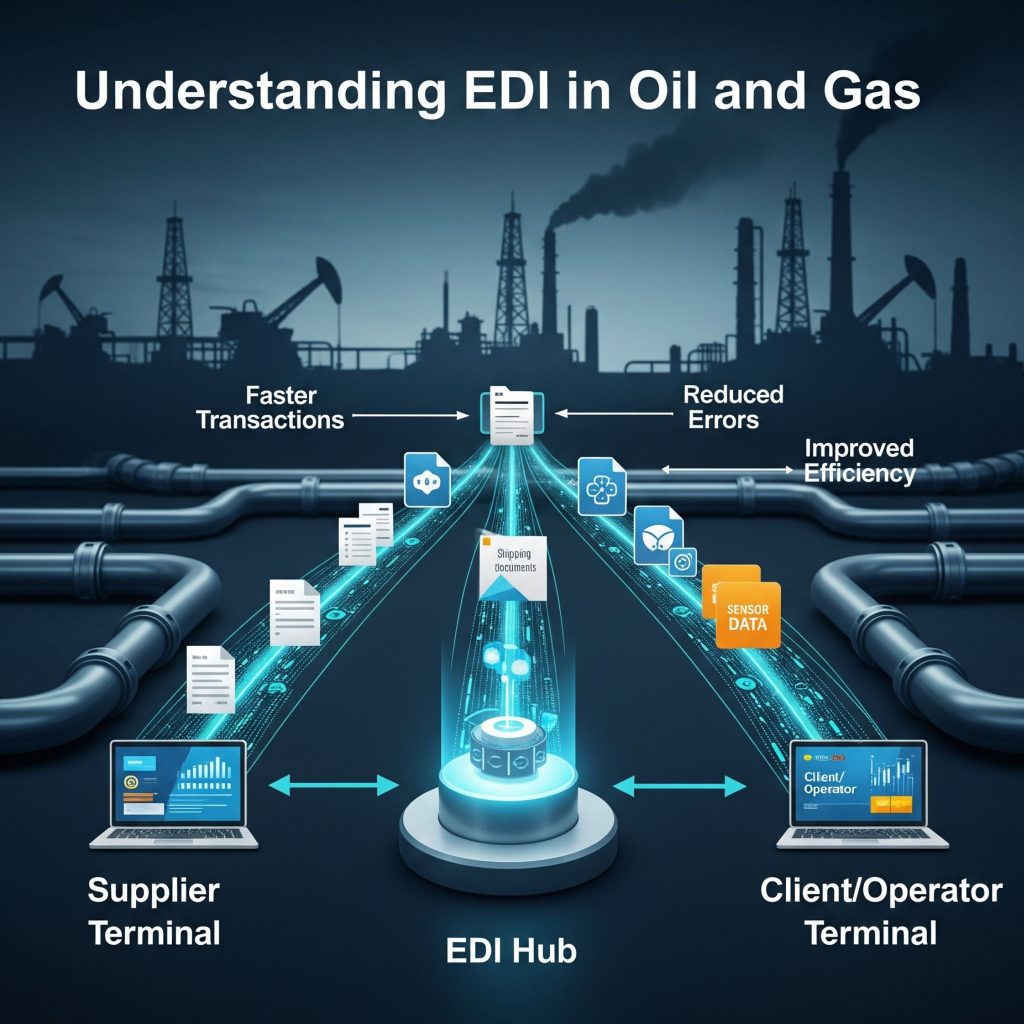

Understanding EDI in Oil and Gas

The petroleum industry runs on data—volumes, prices, specifications, and transaction flow constantly between producers, refiners, distributors, and customers. Electronic data interchange serves as the digital backbone enabling this complex ecosystem to function efficiently.

What is Electronic Data Interchange (EDI)?

Electronic data interchange (EDI) is the computer-to-computer exchange of business documents in standardized electronic formats between companies’ systems. Unlike email, which requires human intervention, EDI enables direct system-to-system communication without manual handling. This technology allows business documents like purchase orders, invoices, and shipping notices to move automatically between organizations.

EDI works through a structured process: first, business data is gathered; then an EDI translator converts this information into a standardized format; finally, the document is transmitted via secure protocols to the recipient’s system, where it’s processed automatically. Essentially, EDI replaces traditional paper-based methods with a fully automated digital process.

Why EDI Matters in the Oil and Gas Industry

For oil and gas companies, EDI isn’t just convenient—it’s economically essential. Traditional paper documents cost between $10-30 each to process, whereas EDI transactions may cost as little as $1-2. Purchase orders specifically average $30 apiece when including paper and personnel costs, while electronic invoicing runs $3-$5 per transaction.

The petroleum sector has embraced EDI more rapidly than many other industries. This technology creates a “single language” for data exchange, eliminating problems caused by disparate systems and formats, allowing information to flow uninterrupted throughout the energy supply chain.

Consequently, EDI delivers substantial operational benefits to oil and gas companies:

- More accurate billing and invoicing processes

- Simpler, faster procurement

- Better inventory management

- Real-time decision-making capabilities

Moreover, EDI reduces reliance on manual processes, minimizing errors and delays that often plague traditional data transmission methods. This automation leads to substantial savings and more efficient resource allocation throughout production and supply operations.

Common EDI Standards Used in Oil and Gas

The oil and gas industry relies on several EDI standards to ensure seamless communication:

ANSI ASC X12 (American National Standards Institute Accredited Standards Committee X12) was developed in 1979 and is primarily used in North America. For the petroleum sector specifically, the American Petroleum Institute created PIDX (Petroleum Industry Data Exchange), which is a subset of X12 designed for oil and gas transactions.

UN/EDIFACT (United Nations rules for Electronic Data Interchange for Administration, Commerce and Transport) is the most widely used EDI format outside North America. This international standard enables global trade and has been adopted by many industries, including energy.

NAESB (North American Energy Standards Board) helps implement standards for reliable, secure transaction exchange over the internet between gas and electric utilities trading partners.

The petroleum industry also uses specialized EDI transaction sets for specific functions:

- Crude Oil Data Exchange (CODE) for crude oil and condensate transactions

- Gas Revenue Accounting Data Exchange (Grade) for natural gas transactions

- Pipeline Information (Pipenet) for pipeline data exchange

Primarily, these standards ensure that all trading partners can communicate regardless of their internal systems. By establishing standardized formats, EDI creates consistent, machine-readable documents that can be processed automatically—essential for an industry with such complex supply chains.

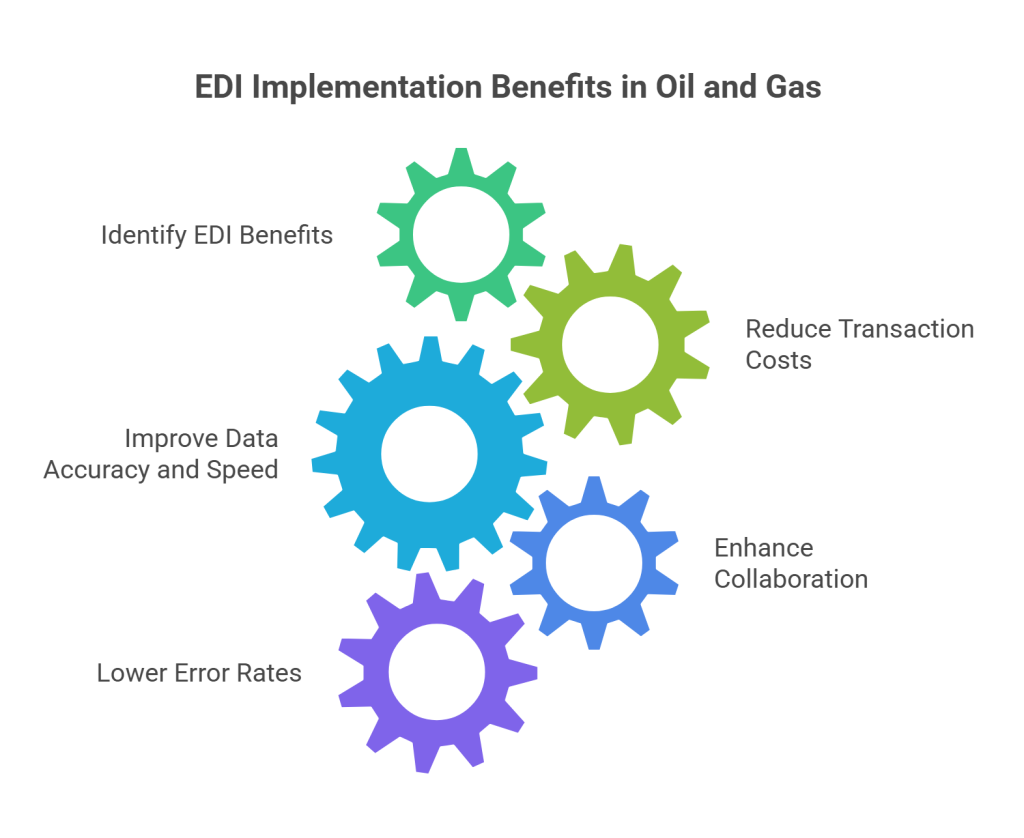

Key Benefits of EDI Implementation

Implementing electronic data interchange delivers substantial advantages throughout the oil and gas value chain. From upstream production to downstream distribution, EDI creates measurable improvements in operations, finances, and partner relationships.

1. Reduced Transaction Costs

The financial benefits of EDI implementation are immediately apparent across petroleum operations. According to industry data, oil and gas companies save an impressive $2.89 for every $1 spent on EDI programs. This return on investment quickly transforms budgetary outlooks.

The cost difference between traditional and electronic methods is striking. Sending a single paper document costs between $10-30, whereas an EDI transaction can cost as little as $1-2. Purchase orders specifically average $30 each when processed on paper, including all associated personnel costs. Electronic invoicing reduces this to $3-5 per transaction, with industry goals to drive costs down further into single digits.

Beyond direct document expenses, EDI solutions eliminate numerous ancillary costs:

- Printing, reproduction, and storage expenses

- Filing and document retrieval costs

- Postage and compliant handling fees

These savings accumulate rapidly throughout the order-to-cash cycle, providing better financial stability for suppliers through more timely cash flows.

2. Improved Data Accuracy and Speed

EDI dramatically accelerates transaction processing across petroleum operations. Studies show EDI reduces order processing times by up to 62%, leading to quicker deliveries and heightened satisfaction among business partners. This acceleration transforms what previously took days or weeks with paper-based methods into matters of minutes.

The speed improvement occurs because EDI enables hands-free order processing, cutting the order-to-shipment time approximately in half. Subsequently, real-time communication allows for quick, informed decision-making—a critical advantage in an industry where responsiveness significantly impacts profitability.

As a result of these improvements, companies can maintain lower inventory levels throughout their supply chains. The shortened order processing and delivery times mean less need to carry excess stock, thereby optimizing working capital.

3. Enhanced Collaboration with Trading Partners

EDI establishes a “unified language” for information exchange across the petroleum industry. This standardization ensures critical data flows easily between stakeholders throughout the supply chain.

Through standardized formats and automated processes, EDI fosters stronger relationships with trading partners by providing a common platform for data exchange. This improved collaboration breaks down communication silos, allowing for real-time coordination between suppliers and distributors.

Trading partner agreements formalize these collaborative relationships. Integrated oil companies are particularly proactive in this area, with 36% always requiring such agreements and 45% recommending them. Among suppliers, 25% always require trading partner agreements, with 35% recommending them.

4. Lower Error Rates in Procurement and Sales

Perhaps most notably, EDI significantly reduces errors throughout petroleum operations. Industry surveys indicate that companies implementing EDI cut their overall error rates by an average of 85%—from 10.6% with paper documents to just 1.6% with EDI across all functions.

The error reduction is particularly pronounced in key operational areas:

- Purchasing: Error rates dropped from 11.7% with paper to 2.2% with EDI

- Sales: Error rates fell from 14% with paper to 1.9% with EDI

- Other functions: Error rates decreased from 1.8% with paper to merely 0.1% with EDI

This dramatic improvement occurs because EDI eliminates error-prone manual data entry and rekeying processes. Built-in validation rules identify errors before processing, thereby minimizing inaccuracies. The resulting improvement in data integrity ensures information is correctly formatted and verified before processing, reducing costly discrepancies.

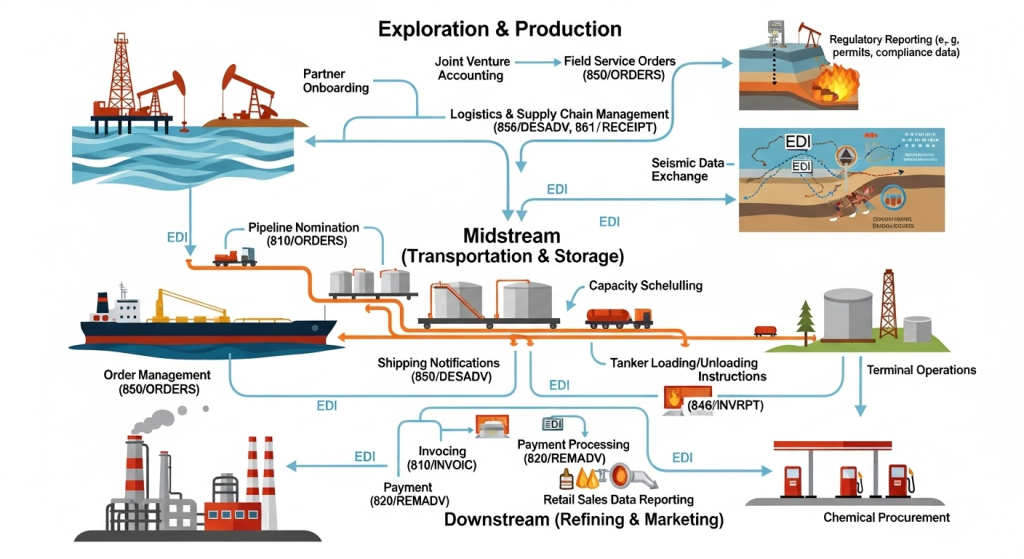

How EDI is Used Across the Oil and Gas Value Chain

Electronic data interchange (EDI) functions as the digital communication foundation across the entire oil and gas value chain. From wellhead to end consumer, standardized data exchange streamlines operations at every stage of petroleum production and distribution.

1. Purchasing and Materials Management

Purchasing and materials management (P&MM) represents one of the earliest EDI applications in the petroleum industry. This implementation facilitates information exchange for purchasing, inventory, logistics, and material control documents. By automating procurement processes, oil and gas companies eliminate paper-based inefficiencies that typically plague supply chain operations.

EDI-enabled purchasing systems directly transmit purchase orders between trading partners, thereby removing manual handling steps that cause delays. Integrated validation checks within these transactions identify errors before processing, minimizing costly discrepancies that often plague traditional procurement methods.

2. Crude Oil and Gas Data Exchange

The movement of raw petroleum resources relies on specialized EDI frameworks tailored to industry needs. The Crude Oil Data Exchange (CODE) supports the electronic transmission of crude oil and condensate run tickets, statements, and tank increments between producers and transporters. This standardization ensures accurate volume tracking throughout the production chain.

Similarly, the Gas Revenue Accounting Data Exchange (Grade) enables transmission of natural gas liquids and natural gas metered volumes, test data, and plant and lease settlement information. These specialized frameworks maintain data integrity during critical custody transfers that occur daily across production operations.

3. Royalty Payments and Joint Interest Billing

Financial transactions between oil and gas partners have been revolutionized through EDI implementation. The Check Stub and Royalty Payments Data Exchange (CDEX) provides formatted data on oil and gas lease check stub details, enabling direct transmission of royalty payment information from lease operators to owners.

Joint Interest Billing (JIB), a specialized accounting practice in oil and gas, divides expenses and revenue from drilling projects among partners based on investment agreements. The Joint Interest Data Exchange (JIDX) electronically processes these complex transactions, including Authorization for Expenditures (AFEX), which supports AFE balloting and approval between operators and working interest owners.

5. Terminal and Pipeline Operations

Terminal operations represent another critical area where EDI delivers significant efficiency gains. Terminal operators use EDI to report receipts and disbursements of liquid petroleum products to regulatory authorities. These electronic reports track every gallon received or disbursed at terminal racks or production facilities.

Pipeline data management likewise benefits from specialized EDI implementations. Pipenet was designed specifically for transmission of product and crude oil pipeline data between pipeline companies, shippers, and refiners. Modern EDI solutions assist interstate pipelines, shippers, and marketers with secure exchange of pipeline transactions, delivering reliable communications at significantly lower costs than in-house solutions.

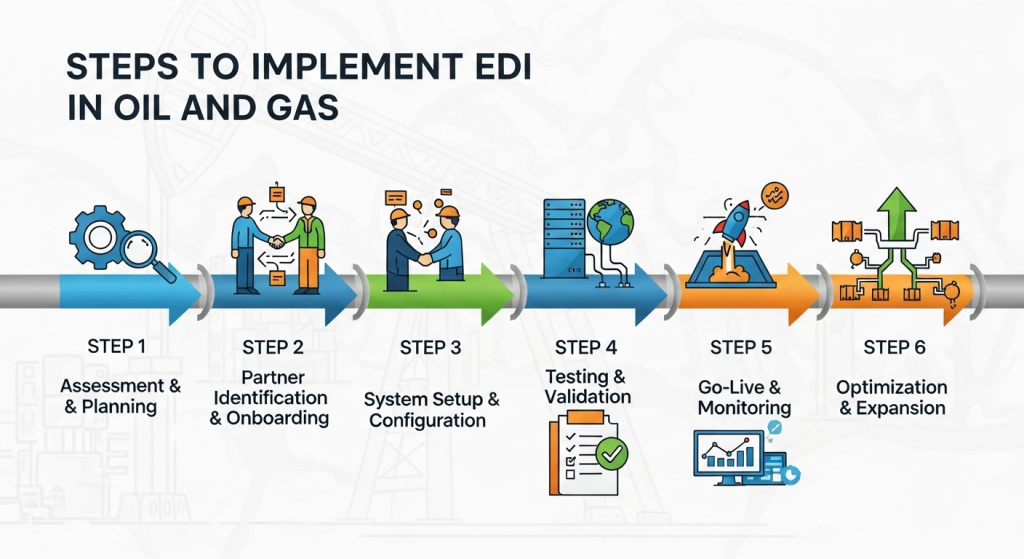

Steps to Implement EDI in Oil and Gas

Successful implementation of EDI in the oil and gas sector requires careful planning and systematic execution. Companies must follow a structured approach to ensure seamless integration with existing systems and trading partners.

1. Assessing Current Systems and Readiness

Initially, energy companies must conduct a comprehensive analysis of all existing systems, communication protocols, and data formats in their supply chain. This assessment provides a clear picture of integration needs and identifies specific problems that EDI can solve.

Before implementation, companies should consider these key readiness factors:

- Identifying all trading partners and having current data about them

- Obtaining specifications from trading partners regarding document types

- Knowing all applicable EDI document types for your business

- Determining if you need a Value-Added Network (VAN)

- Assessing if you have appropriate staff available for implementation

2. Choosing the Right EDI Integration Method

The selection process involves careful evaluation of potential EDI software or platforms. Companies should consider factors such as scalability to accommodate changing needs and compatibility with existing energy management systems.

Budget considerations are essential—though companies can save money by implementing directly, this approach requires internal resources with extensive EDI experience. For many oil and gas companies, third-party specialists offer more cost-effective implementation.

Commport EDI solutions, #1 EDI provider trusted by 6000+ brands with over 40+ years of industry experience our EDI solutions can easily connect with any trading partner and integrate directly with all Major ERP providers and other backend office systems for seamless data translation into any specific formats.

Recommend

3. Establishing Trading Partner Agreements

Trading partner agreements formalize electronic communication protocols between companies. These documents outline technical specifications, security measures, and transaction handling procedures.

Once an agreement is established, companies must coordinate with their trading partners during implementation. This includes exchanging identifying qualifiers and conducting reasonable testing before authorizing electronic transmissions. This coordination ensures all parties are prepared for the transition to electronic transactions.

4. Ensuring compliance with EDI standards

Oil and gas companies typically use several EDI standards:

- ANSI X12 (primarily used in North America)

- UN/EDIFACT (most common format internationally)

- NAESB (North American Energy Standards Board) standards for gas and electric utilities

Compliance with these standards requires thorough EDI testing. Companies should evaluate end-to-end transaction flows, data mapping accuracy, and error handling procedures. Even after implementation, regular monitoring and optimization remain necessary to maintain system performance and address emerging challenges.

Trends and Future of EDI in the Oil & Gas Industry

Looking ahead, several technological innovations are set to transform EDI in the oil and gas sector.

1. Cloud-based EDI Adoption

Traditional EDI relied on proprietary networks and value-added networks (VANs), yet the industry is rapidly embracing Web EDI that leverages internet technologies instead. This approach offers a more accessible and cost-effective alternative for businesses of any size. Cloud-based EDI platforms eliminate the need for costly infrastructure investments and ongoing maintenance, resulting in significant cost savings. Beyond economics, these platforms provide exceptional scalability, allowing oil and gas companies to easily handle increased data volumes and adapt to changing market conditions.

2. Integration with AI and Machine Learning

AI now serves as a vigilant gatekeeper within EDI platforms, validating documents before transmission and identifying simple errors like missing fields or incorrect formatting. Machine learning algorithms analyze historical transactions to recognize recurring mistakes in EDI data, including invalid product codes, incorrect addresses, and pricing errors. Intelligent document matching utilizes AI models to automate linking related documents to corresponding purchase orders. Still more impressive, AI forecasting capabilities analyze both real-time and historical data to predict future demand, helping companies optimize inventory levels throughout their supply chains.

3. EDI in Regulatory Reporting and Compliance

Numerous states have mandated that utility companies use EDI technology for enrollments and meter readings from transmission and distribution providers. The Gas Industry Standards Board Electronic Delivery Mechanism (GISB EDM) standards require all transaction data be exchanged in standardized formats (ANSI X12). Alongside these requirements, the North American Energy Standards Board (NAESB) assists with implementing standards for reliable, secure exchange between gas and electric utilities trading partners.

4. Expanding EDI to New Business Areas

As enterprises prepare to handle perceived risks from geopolitical or logistics disruptions, the ability to quickly onboard new partners has become an essential capability. AI-powered partner onboarding solutions enable manufacturing, retail, logistics, and oil and gas enterprises to rapidly integrate new supply chain participants. These advancements create comprehensive visibility across operations, offering real-time insights into customer fulfillment, procurement lead times, and supply chain delays.

Conclusion

The adoption of EDI throughout the oil and gas industry represents a significant technological advancement that delivers measurable benefits at every operational level. As we’ve seen, companies save nearly $3 for each dollar invested in EDI solutions, while simultaneously reducing error rates by an impressive 85% across procurement and sales functions. These financial advantages, coupled with dramatically improved processing speeds and enhanced data accuracy, make EDI implementation practically essential for competitive operations.

Electronic data interchange stands as the digital backbone that enables seamless communication between producers, refiners, distributors, and customers throughout the petroleum value chain. The standardized formats provided by ANSI X12, UN/EDIFACT, and NAESB ensure all stakeholders speak the same digital language, therefore eliminating costly miscommunications and delays.

Most importantly, EDI technology continues evolving to meet industry challenges. The shift toward internet-based systems, cloud platforms, and AI integration promises even greater efficiencies in the future. These advancements will undoubtedly transform how oil and gas companies manage data, make decisions, and comply with regulatory requirements.

The evidence remains compelling – organizations that embrace EDI gain significant competitive advantages through reduced costs, faster transactions, and better partner relationships. Though implementation requires careful planning and coordination, the return on investment makes this technology transformation well worth the effort. Companies that fail to adopt these standards risk falling behind in an industry where efficiency and accuracy directly impact the bottom line.

Commport EDI Solutions - #1 EDI Solutions Platform

Need Help? Download: Commport's EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI (Electronic Data Interchange) is a system for computer-to-computer exchange of business documents in standardized formats. In the oil and gas industry, it significantly reduces transaction costs, improves data accuracy, enhances collaboration between partners, and lowers error rates in procurement and sales processes.

The oil and gas industry primarily uses ANSI ASC X12 (in North America), UN/EDIFACT (internationally), and NAESB (North American Energy Standards Board) standards. Specialized standards like PIDX, CODE, and Grade are also used for specific oil and gas transactions.

EDI implementation can lead to substantial cost savings. Companies typically save $2.89 for every $1 spent on EDI solutions. Traditional paper documents cost $10-30 each to process, while EDI transactions can cost as little as $1-2, significantly reducing operational expenses.

The main steps include assessing current systems and readiness, choosing the right EDI integration method, establishing trading partner agreements, and ensuring compliance with EDI standards. It’s crucial to coordinate with trading partners and conduct thorough testing before full implementation.

Key trends include the adoption of internet-based EDI and cloud platforms, integration with AI and machine learning for improved data processing and forecasting, enhanced regulatory reporting capabilities, and the expansion of EDI to new business areas for better supply chain management and partner onboarding.