Introduction

Electronic Data Interchange (EDI) has become the backbone of efficient business-to-business communications. At the heart of every successful EDI implementation lies a critical document that often determines the success or failure of electronic business relationships with the EDI trading partner agreement. This comprehensive legal framework establishes rules, responsibilities, and technical specifications that govern how trading partners exchange electronic documents and conduct business in the digital realm.

As organizations continue to digitalize their operations and supply chains, understanding the intricacies of EDI trading partner agreements has never been more crucial. The global EDI software market, valued at US$34.02 billion in 2024 and projected to reach US$74.36 billion by 2031, demonstrates the critical importance of establishing robust trading partner relationships that can support this exponential growth.

Key Takeaways

- Foundation of Trust: An EDI trading partner agreement isn’t just a document—it’s a trust-building mechanism. It defines how businesses collaborate digitally, ensuring that operations run smoothly and disputes are minimized.

- Strategic Advantage: Companies that invest in strong TPAs enjoy faster onboarding, fewer transaction errors, and greater partner satisfaction, giving them a significant edge in competitive industries like retail, logistics, and healthcare.

- Legal and Regulatory Shield: With increasing global focus on data security and compliance, TPAs serve as a legal framework that helps businesses stay audit-ready and protected against regulatory violations.

- Facilitator of Growth: As businesses scale and add new partners, having a modular, scalable TPA strategy ensures faster expansion without increasing operational risk.

- Living Document: Finally, a TPA is not a one-and-done initiative. It must evolve as technologies, regulations, and business models change. Regular reviews and updates keep your EDI network resilient and future-proof.

What is an EDI Trading Partner Agreement?

An EDI trading partner agreement is a formal contract between business entities that outlines the terms and conditions under which they will exchange data electronically. This agreement ensures that both parties adhere to a standardized format for electronic transactions, facilitating seamless communication. By detailing the technical and procedural aspects of data exchange, the agreement serves as a blueprint for efficient and error-free collaboration.

The EDI trading partner agreement typically includes specifications on data formats, transmission protocols, and security measures. These components are crucial for maintaining data integrity and ensuring that information is transmitted accurately and securely. The agreement also establishes guidelines for resolving disputes, managing errors, and handling exceptions, thereby minimizing potential disruptions in business operations.

In essence, the EDI trading partner agreement lays the foundation for a transparent and accountable relationship between trading partners. It is an integral part of modern supply chain management, enabling businesses to automate transactions, reduce manual errors, and improve operational efficiency. By clearly defining roles and responsibilities, it ensures that all parties are aligned in their goals and expectations.

Key Components of an EDI Trading Partner Agreement

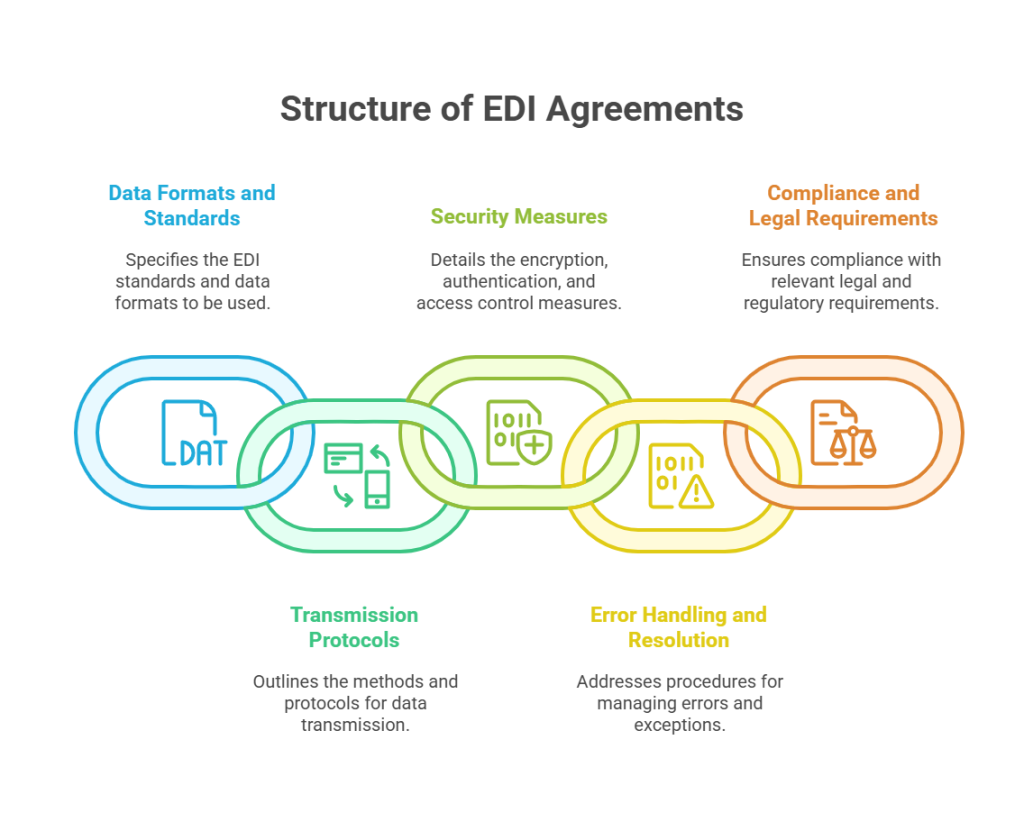

An effective EDI trading partner agreement comprises several key components that ensure smooth and efficient electronic communication between parties. These components include:

- Data Formats and Standards: This section specifies the EDI standards and data formats to be used, including ANSI X12, EDIFACT, and XML. It ensures that both parties are aligned in the structure and content of the data exchanged.

- Transmission Protocols: The agreement outlines the methods and protocols for data transmission, such as AS2, FTP, or VAN. This ensures secure and timely transfer of information between trading partners.

- Security Measures: Security is paramount in electronic data exchange. The agreement details the encryption, authentication, and access control measures to protect sensitive information from unauthorized access and breaches.

- Error Handling and Resolution: This component addresses the procedures for managing errors and exceptions in data transmission. It includes guidelines for error detection, notification, and resolution to minimize disruptions.

- Compliance and Legal Requirements: The agreement ensures compliance with relevant legal and regulatory requirements, such as data protection laws and industry-specific standards. It also defines the legal obligations and liabilities of each party.

By incorporating these components, an EDI trading partner agreement provides a comprehensive framework for managing electronic transactions. It ensures that both parties have a clear understanding of their roles and responsibilities, thereby reducing the risk of misunderstandings and disputes.

The Strategic Importance of Well-Structured Agreements

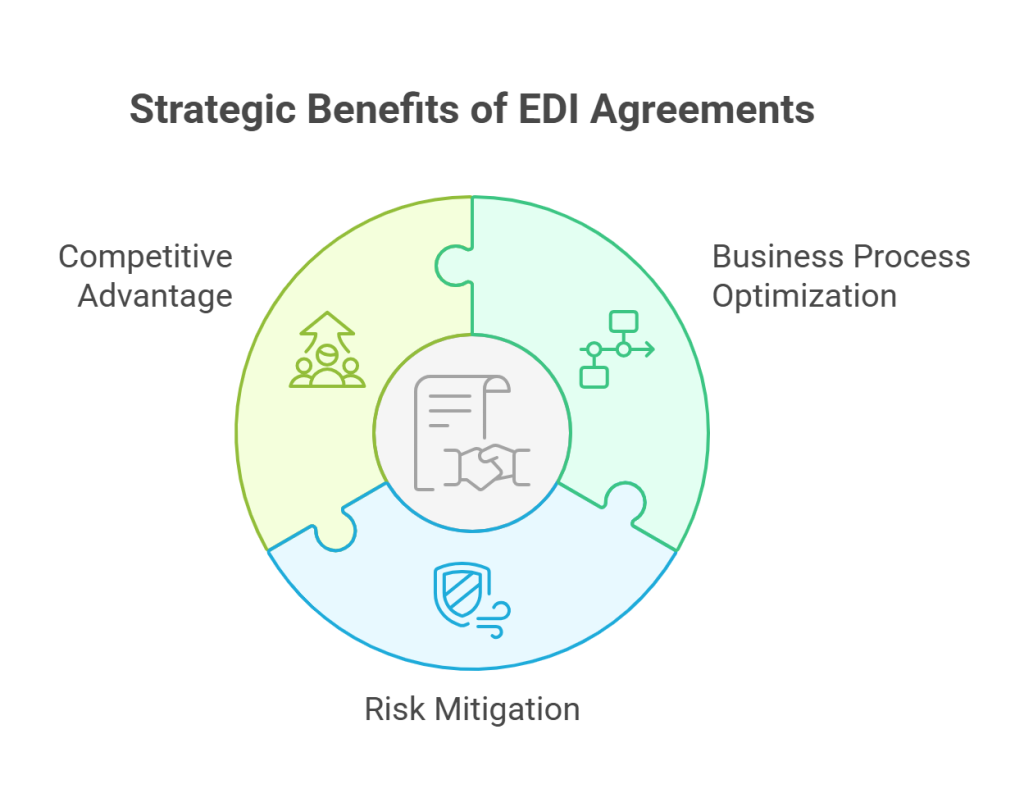

1. Business Process Optimization

Well-crafted EDI trading partner agreements serve as catalysts for business process optimization by establishing clear expectations and standardized procedures. When partners have explicit agreements about transaction formats, timing, and error handling, they can design their internal processes to maximize efficiency and minimize manual intervention.

The optimization benefits extend beyond simple automation. Organizations with comprehensive trading partner agreements can implement exception-based processing, where only transactions that deviate from normal parameters require human attention. This approach dramatically reduces processing costs while improving accuracy and speed.

Furthermore, standardized agreements enable organizations to scale their EDI operations more effectively. When new trading partners join the network, existing agreement templates can accelerate onboarding while ensuring consistency across all relationships.

2. Risk Mitigation and Compliance Assurance

EDI trading partner agreements serve as powerful risk mitigation tools by establishing clear boundaries and responsibilities for electronic commerce activities. The agreements help organizations avoid costly misunderstandings that could disrupt supply chains or damage business relationships.

Compliance assurance represents another critical benefit of well-structured agreements. Organizations operating in regulated industries can use trading partner agreements to demonstrate their commitment to maintaining appropriate controls over electronic transactions. This documentation becomes particularly valuable during regulatory audits or compliance reviews.

The risk mitigation benefits extend to cybersecurity concerns as well. Agreements that establish strong security requirements and regular security assessments help protect all parties from data breaches and cyberattacks. This protection becomes increasingly important as cyber threats continue to evolve and target electronic commerce systems.

3. Competitive Advantage Through Partnership Optimization

Organizations that invest in developing comprehensive EDI trading partner agreements often discover that these documents become sources of competitive advantage. Partners with well-defined agreements can respond more quickly to market opportunities, adapt to changing business requirements, and provide superior customer service.

Competitive benefits manifest in various ways. Organizations with streamlined EDI operations can offer shorter lead times, more accurate delivery schedules, and better visibility into order status. These capabilities become significant differentiators in competitive markets where customer service excellence determines market share.

Additionally, comprehensive trading partner agreements facilitate innovation by establishing frameworks for testing new transaction types, implementing emerging technologies, and expanding business relationships. Partners with strong foundational agreements can more easily pilot new capabilities such as real-time inventory updates, automated replenishment, or advanced shipping notices.

How to Create an Effective EDI Trading Partner Agreement

Creating an effective EDI trading partner agreement involves a collaborative approach between all parties involved, including IT, legal, compliance, and business operations.

It begins with a thorough assessment of the business processes and data exchange requirements. By understanding the specific needs and objectives of each party, the agreement can be tailored to address these requirements effectively.

The next step is to define the technical specifications, including data formats, transmission protocols, and security measures. This requires input from IT and legal teams to ensure that the agreement is technically sound and legally compliant. Clear documentation of these specifications is crucial for ensuring that all parties have a shared understanding of the terms and conditions.

Once the technical aspects are finalized, the agreement should address operational procedures, such as error handling, dispute resolution, and compliance requirements. It is essential to include provisions for regular reviews and updates to accommodate changes in technology, business processes, and regulations. By establishing a framework for ongoing communication and collaboration, the agreement remains relevant and effective over time.

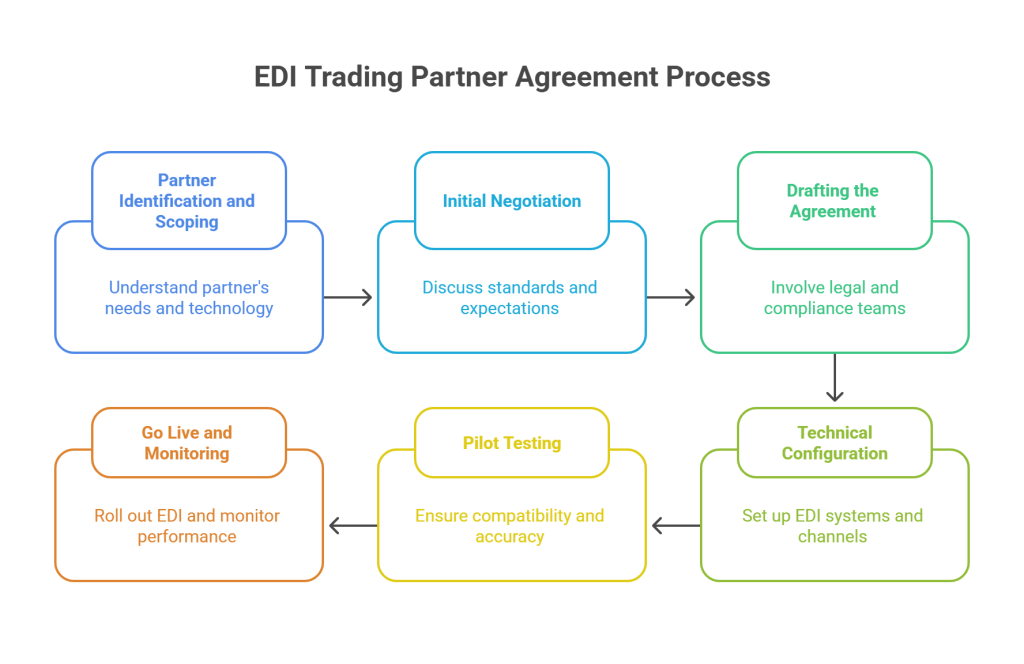

Here is a step-by-step overview:

Step 1: Partner Identification and Scoping

Understand your trading partner’s needs, technology stack, and document exchange requirements.

Step 2: Initial Negotiation

- Discuss EDI standards, document sets, and expectations.

- Align on protocols, security, and SLAs.

Step 3: Drafting the Agreement

Involve legal and compliance teams to draft an agreement that covers all technical and legal bases.

Step 4: Technical Configuration

- Set up EDI systems and communication channels.

- Conduct connectivity and security testing.

Step 5: Pilot Testing

Run a pilot project to ensure compatibility and transaction accuracy.

Step 6: Go Live and Monitoring

- Roll out the EDI exchange under the agreed parameters.

- Continuously monitor performance and SLA adherence.

Proper documentation and change management processes must be in place to address evolving needs or technological upgrades.

Common Challenges and Pitfalls in Agreement Development

While EDI trading partner agreements offer numerous benefits, they also present certain challenges that businesses must address

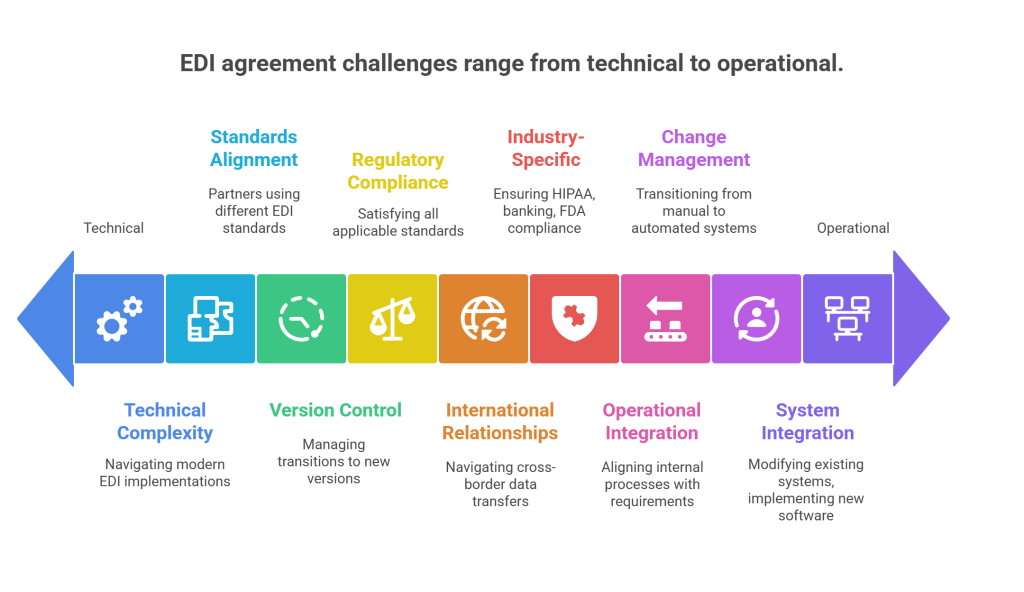

1. Technical Complexity and Standards Alignment

One of the most significant challenges in developing EDI trading partner agreements lies in navigating the technical complexity of modern EDI implementations. Organizations must balance the need for comprehensive technical specifications with the practical realities of system capabilities and implementation timelines.

Standards alignment presents a particular challenge when trading partners use different EDI standards or versions. For example, one partner may prefer ANSI X12 formats while another uses EDIFACT standards. The agreement must address these differences while ensuring that both parties can effectively process exchanged data.

Version control represents another technical challenge. EDI standards evolve continuously, and partners must establish procedures for managing transitions to new versions. The agreement should specify how partners will coordinate upgrades, test new versions, and maintain backward compatibility during transition periods.

Regulatory Compliance Complexities

Regulatory compliance adds layers of complexity to EDI trading partner agreement development, particularly for organizations operating across multiple industries or geographic regions. Different regulations may impose conflicting requirements, making it challenging to develop agreements that satisfy all applicable standards.

International trading relationships face additional compliance challenges related to cross-border data transfers, varying privacy regulations, and different legal frameworks. The agreement must navigate these complexities while ensuring that all parties can meet their respective regulatory obligations.

Industry-specific regulations create another layer of compliance complexity. Healthcare organizations must ensure compliance, financial services firms must adhere to various banking regulations, and food companies must satisfy FDA tracking requirements. Each regulatory framework imposes unique requirements that must be reflected in the trading partner agreement.

3. Operational Integration Challenges

Even well-designed EDI trading partner agreements can face implementation challenges related to operational integration. Organizations must align their internal processes with agreement requirements while maintaining operational efficiency and flexibility.

Change management represents a significant operational challenge. Employees accustomed to manual processes may resist transitioning to automated EDI systems, particularly if the changes require new skills or modified workflows. The agreement should anticipate these challenges and establish procedures for managing organizational change.

System integration complexities can also impede successful implementation. Organizations may need to modify existing systems, implement new software, or establish connections with third-party networks. The agreement should address these technical requirements while providing flexibility for different implementation approaches.

Best Practices for Managing EDI Trading Partner Agreements

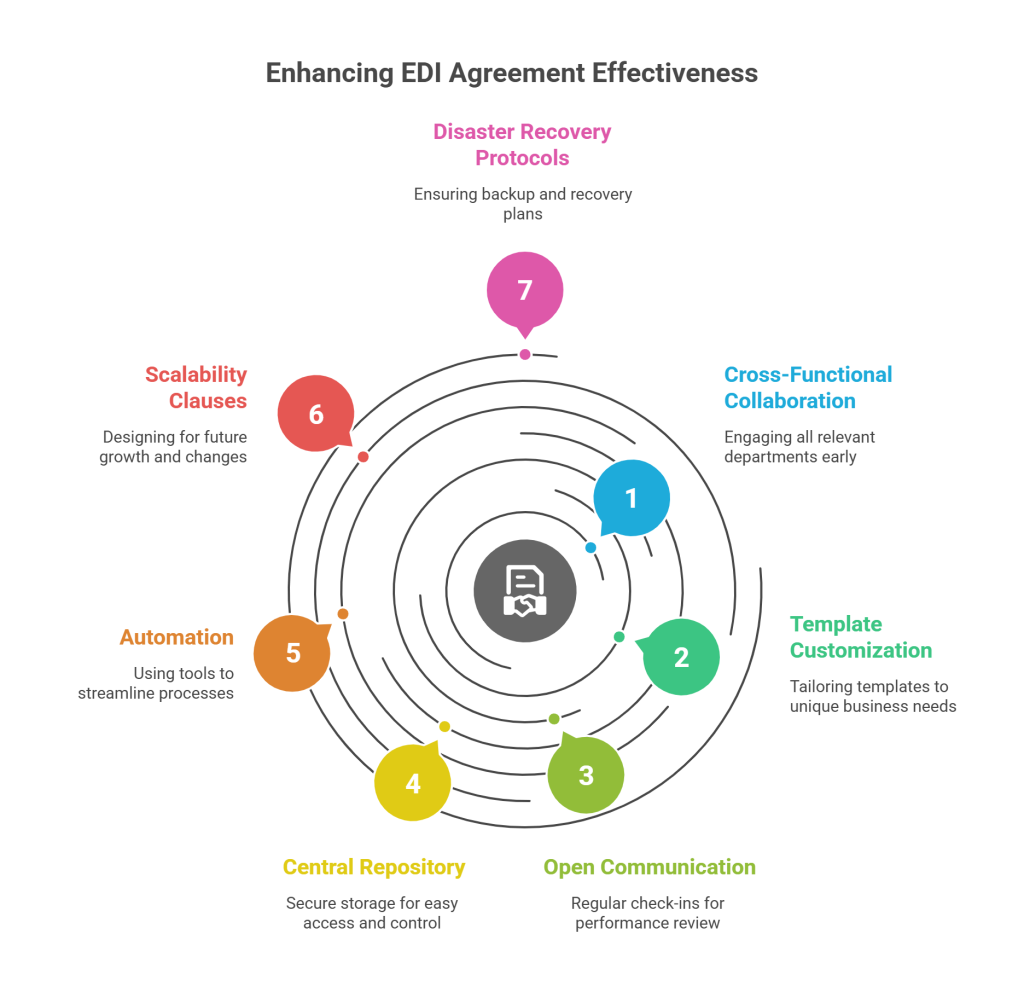

The effectiveness of an EDI trading partner agreement depends largely on the thoroughness and foresight of its design. Here are some best practices to ensure success:

- Collaborate Cross-Functionally

Engage all relevant departments early in the process—legal, IT, finance, compliance, and operations. This ensures holistic coverage of all expectations and requirements.

- Use Templates but Customize

Industry-standard trading partner agreement templates are a great starting point, but must be customized for your unique business processes and risks.

- Keep Communication Open

A trading partner agreement should not be a static document. Schedule regular partner check-ins to review performance and address concerns.

- Maintain a Central Repository

Store all trading partner agreements in a centralized, accessible, and secure digital repository to facilitate audits, reviews, and version control.

- Automate Where Possible

Use tools that automate partner onboarding, EDI document validation, and performance monitoring.

- Include Scalability Clauses

Design agreements that can grow with your business, accommodating more document types, trading partners, or regulatory requirements.

- Build in Disaster Recovery Protocols

Ensure you have backup systems, data recovery plans, and emergency contact protocols detailed in your trading partner agreement.

Proactive planning and transparency are your best allies in making the trading partner agreement a living, evolving success factor in your EDI ecosystem.

Conclusion

EDI trading partner agreements are essential for fostering effective collaboration between businesses. By establishing a clear framework for electronic data exchange, these agreements enable companies to streamline operations, reduce costs, and improve accuracy.

To maximize the benefits of EDI trading partner agreements, businesses should adopt a strategic approach, incorporating best practices and leveraging the right tools and software. With solutions like Commport EDI, businesses can achieve seamless integration with trading partners, ensuring compliance and efficiency.

As the business landscape continues to evolve, EDI trading partner agreements will remain a critical component of successful supply chain management. By embracing these agreements, businesses can enhance collaboration, drive growth, and achieve their strategic objectives.

Commport EDI Solutions

Need Help? Download: Commport's EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI Trading Partner Agreements should be formally reviewed annually, with more frequent assessments triggered by significant business changes, technology upgrades, or regulatory developments. Annual reviews should evaluate agreement performance against established metrics, assess changes in business volumes and transaction types, review security requirements and compliance obligations, and consider emerging technology opportunities. Immediate reviews may be necessary when organizations implement new ERP systems, change VAN providers, expand into new markets, or face new regulatory requirements. Technology-driven updates often occur every 2-3 years as EDI standards evolve, security protocols advance, or communication methods change. Business-driven updates may be required more frequently if trading relationships expand, transaction volumes grow significantly, or new business processes are implemented. The key is establishing a regular review schedule while maintaining flexibility to address urgent changes that could impact agreement effectiveness or compliance obligations.

Value-Added Networks (VANs) serve as intermediaries that facilitate EDI communications between trading partners and often play a significant role in Trading Partner Agreement structures. VANs provide network infrastructure, protocol conversion services, data validation, delivery confirmation, and technical support that can simplify agreement negotiations by standardizing many technical requirements. When partners use the same VAN, the agreement may reference the VAN’s standard service level agreements and technical specifications rather than negotiating these details independently. VANs also provide mailboxing services that allow partners to exchange documents asynchronously, reducing dependencies on system availability timing. However, VAN usage introduces additional considerations such as service provider reliability, data security in third-party environments, cost allocation between trading partners, and procedures for handling VAN service disruptions. Some agreements specify backup communication methods or alternative VANs to ensure business continuity if primary VAN services become unavailable.

Small businesses can definitely benefit from EDI Trading Partner Agreements, though their approach may differ from large enterprise implementations. Many small businesses are required to implement EDI capabilities to maintain relationships with larger trading partners such as major retailers, distributors, or manufacturers. Cloud-based EDI solutions have made implementation more accessible and cost-effective for smaller organizations, with monthly subscription models replacing large upfront investments. Small businesses often benefit from simplified agreement templates and standardized transaction sets rather than highly customized implementations. The key benefits include reduced manual processing costs, improved accuracy, faster payment processing, and enhanced competitiveness when bidding for contracts with larger organizations. Many small businesses report that EDI capabilities have enabled them to expand their customer base and compete more effectively against larger competitors by demonstrating professional operational capabilities and reliability.

When trading partners use different EDI standards or versions, the Trading Partner Agreement must establish translation or mapping procedures to ensure compatibility. Common scenarios include one partner using ANSI X12 while another uses UN/EDIFACT, or partners operating on different versions of the same standard. The agreement typically designates a “common denominator” format or requires one partner to translate their data into the other’s preferred format. Translation services may be provided by Value-Added Networks (VANs), middleware solutions, or custom integration software. The agreement must specify who bears responsibility for translation accuracy, error handling when translations fail, and procedures for testing translated documents. Version management becomes particularly important during standard upgrades, with agreements establishing transition timelines, backward compatibility requirements, and coordination procedures for implementing new versions across all trading partners.

An EDI Trading Partner Agreement is a specialized contract that specifically addresses the technical, operational, and legal aspects of electronic data interchange. Unlike standard business contracts that focus primarily on commercial terms, EDI agreements include detailed technical specifications such as communication protocols, data formats, security requirements, and system performance standards. They also address unique legal considerations related to electronic signatures, data authentication, and liability for electronic transaction errors. While a standard contract might specify what products to buy and at what price, an EDI Trading Partner Agreement defines how the electronic purchase orders, invoices, and shipping notices will be formatted, transmitted, and processed.

The timeline for EDI Trading Partner Agreement development varies significantly based on complexity, the number of transaction types, and organizational readiness. Simple agreements with established trading partners using standard transaction sets can be completed in 4-6 weeks. More complex agreements involving multiple transaction types, custom data requirements, or stringent security protocols may require 3-6 months for negotiation and implementation. Large retail or manufacturing organizations often require 6-12 months for comprehensive agreements that include multiple trading partners, extensive testing requirements, and integration with existing business systems. The key factors affecting timeline include technical complexity, regulatory compliance requirements, legal review processes, and the availability of technical resources for testing and implementation.

The most frequent mistakes include underestimating technical complexity, failing to involve key stakeholders early in the process, and creating agreements that are too rigid to accommodate future changes. Many organizations focus exclusively on technical specifications while neglecting operational procedures, error handling protocols, and business continuity planning. Another common error is assuming that all trading partners have similar technical capabilities, leading to agreements that some partners cannot reasonably implement. Organizations also frequently overlook the importance of testing procedures and fail to establish comprehensive performance monitoring mechanisms. Finally, many agreements lack clear escalation procedures for resolving disputes or handling system failures, which can lead to costly disruptions when problems occur.