Introduction to EDI Payments

EDI payments refer to the use of EDI to facilitate the exchange of payment information between two parties. This can include information such as the amount of the payment, the payment method, and any relevant details about the payment, such as the invoice number or the reason for the payment.

EDI is not a form of payment. It is a data format used for computer-to-computer data and message exchanges for a variety of payment and payment-related processes. EDI, unlike EFT and ACH, is typically used to format business invoices and remittance information.

EDI payments can be used for a variety of purposes, including paying invoices, making employee payroll payments, and settling accounts between businesses. EDI payments are typically faster and more efficient than traditional paper-based payment methods, as they can be processed automatically and do not require manual intervention. They also reduce the risk of errors or fraud, as the information is transmitted electronically rather than entered manually.

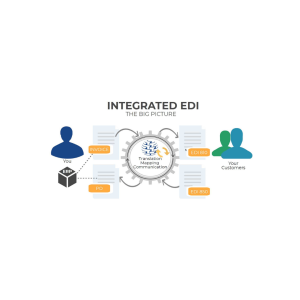

An EDI payment uses globally accepted standards to transmit payment data between your customers, suppliers, and trading partners. Since EDI payments are quick and use a consistent way of exchanging data, businesses across industries use it via a direct connection to their trading partners, or they outsource the EDI connections via VANs/brokers.

The primary EDI transaction set for payments is EDI 820, known as the Payment Order/Remittance Advice. This transaction set carries critical information about payments, including:

Payment amount and currency

Payment method and date

Invoice references and adjustments

Remittance details

Tax information

Discount application

EDI payments eliminate the need for paper checks, manual reconciliation, and error-prone data entry, creating a seamless connection between procurement, invoicing, and payment processes. According to NACHA (National Automated Clearing House Association), businesses using integrated electronic payment solutions reduce payment processing costs by 60-80% compared to paper-based methods.

Key Takeaways

Payment Information Exchange Mechanism: EDI payments are not actual fund transfers but rather a standardized format for exchanging payment-related information between business systems. This distinction is crucial—EDI provides the structured communication framework while actual money movements occur through EFT (Electronic Funds Transfer) or ACH (Automated Clearing House) methods.

Transaction Documentation Framework: The EDI 820 transaction (Payment Order/Remittance Advice) serves as the primary payment-related EDI document, automatically transmitting detailed payment information directly into receivable systems. This eliminates manual data entry, reduces processing errors, and creates an auditable electronic trail of payment activities.

Implementation Methodologies: Businesses can implement EDI payments through various approaches, including Web EDI (using standard internet browsers with online forms) for smaller organizations with occasional needs, or Direct/Point-to-Point EDI for larger enterprises requiring multiple daily transactions with established trading partners.

Business Process Enhancement: Implementing EDI payments delivers substantial operational benefits including stronger trading partner relationships, enhanced data security through closed networks, dramatically faster processing times through real-time transaction clearing, and significant cost reductions by eliminating manual paper-based processes.

Comparative Electronic Payment Framework: While often confused with other electronic payment methods, EDI serves a distinct purpose in the payment ecosystem. Unlike ACH (a specific payment network) or EFT (an umbrella term for electronic payments), EDI specifically handles the structured formatting and secure transmission of payment-related business documents.

The Evolution of B2B Payment Systems

The journey toward electronic payments has evolved significantly over the decades:

Paper-Based Era (Pre-1970s): Business payments were dominated by paper checks, requiring manual processing, physical delivery, and manual reconciliation.

Early Electronic Payments (1970s-1990s): Introduction of Electronic Funds Transfer (EFT) and Automated Clearing House (ACH) networks, enabling electronic movement of funds but often disconnected from supporting documentation.

EDI Payment Integration (1990s-2000s): Development of standards linking payment instructions with remittance information, creating more comprehensive payment automation.

Internet-Enabled Solutions (2000s-2010s): Web-based platforms making electronic payments more accessible to smaller organizations.

Modern Integrated Systems (Current): Seamless integration between ERP systems, banking platforms, and trading partner networks, with enhanced security and real-time capabilities.

This evolution reflects a persistent drive toward greater efficiency, security, and integration in business payment processes. According to a recent study by PYMNTS.com, 76% of businesses now rank payment automation as a high or critical priority, reflecting its strategic importance.

What Payment-Related Information is Exchanged Using EDI Transactions?

Details of the payer and payee: Name and address

Payment information: Credit/debit card or bank information

Transaction details: invoice number, purchase order, reference number

Currency: The total amount in the currency to be exchanged

Check or payment number & Payment amount

The payment date/remittance date

What is an Example of an EDI Payment Transactions?

Remittance information

Invoices

Purchase Orders

Inventory and customs documents

Shipping Notices

Bills of Lading

"EDI payment process involves the exchange of electronic documents and the automation of financial transactions, allowing businesses to streamline and automate their financial processes"

Manual Payment Process Vs EDI Payment Process

Manual Payment Process

EDI Payment Process

The manual payment process typically involves the following steps:

- Generating an invoice: A business generates an invoice and sends it to the customer, either by mail or electronically.

- Receiving payment: The customer reviews the invoice and decides how to pay it. This may involve writing a check or making an electronic payment using a credit card or online payment service.

- Processing payment: The business receives the payment and processes it manually, either by depositing the check or entering the payment information into their accounting software.

- Recording payment: The business records the payment in their financial records and updates the customer’s account to reflect the payment.

Overall, the manual payment process involves a series of manual steps that can be time-consuming and prone to errors. In contrast, EDI payments allow businesses to automate and streamline their financial processes, improving efficiency and reducing the risk of errors.

The EDI payment process typically involves the following steps:

- Setting up an EDI system: To use EDI payments, businesses must first set up an EDI system, which involves installing software and establishing connectivity with trading partners.

- Sending and receiving EDI documents: Once the EDI system is set up, businesses can begin sending and receiving EDI documents, such as invoices and payment instructions. These documents are typically transmitted via a secure network or through an EDI service provider.

- Validating and processing EDI documents: When an EDI document is received, it must be validated to ensure that it is complete and conforms to the necessary standards. If the document is valid, it can be processed automatically or manually, depending on the business’s preferences.

- Making or receiving payments: If the EDI document contains payment instructions, the payment can be processed automatically through the EDI system. This may involve debiting or crediting the appropriate bank accounts or other financial accounts.

Key Components of EDI Payment Systems

A comprehensive EDI payment solution encompasses several essential components:

1. Payment Instruction Exchange

The secure transmission of payment orders between businesses and financial institutions, specifying payment amounts, recipients, and timing.

2. Remittance Information

Detailed data explaining what the payment covers, including invoice references, line-item details, adjustments, and discount application.

3. Financial EDI Standards

Specialized formats (like X12 820 or UN/EDIFACT PAYORD) define the structure and content of payment-related messages.

4. Banking Integration

Secure connections with financial institutions to execute the actual funds transfer via ACH, wire transfer, or other electronic payment methods.

5. Reconciliation Systems

Automated matching of payments with invoices, purchase orders, and other financial documents to ensure accuracy and completeness.

6. Security Infrastructure

Robust encryption, authentication, and access controls protect sensitive financial information throughout the payment process.

Research by the Association for Financial Professionals indicates that organizations with fully integrated payment systems spend 81% less time on payment processing and reconciliation compared to those using partially automated or manual systems.

Why Businesses Should Use EDI Payments?

EDI payments can help businesses streamline and automate their financial processes, improving efficiency and saving time and resources. By automating manual tasks such as invoice processing, businesses can reduce the risk of errors and improve the accuracy of their financial data.

EDI payments can also help businesses save money on paper, printing, and postage costs, as well as streamline their supply chain processes. For example, the EDI 820 payment, which is a type of EDI transaction specifically designed for handling payment instructions, can help businesses automate the payment process and reduce the need for manual intervention.

Overall, EDI payments offer several benefits to businesses looking to improve their financial processes and reduce costs. By using EDI payments, businesses can streamline their financial operations and improve their productivity, making it easier to focus on other important tasks.

Who Uses EDI Payments?

EDI payments are used by a wide variety of businesses and organizations in many different industries. They are particularly common in industries where there is a large volume of transactions and where there is a need for fast and efficient payment processing, such as:

Manufacturing

EDI payments are often used by manufacturers to pay for raw materials, supplies, and other goods and services.

Retail

Retail businesses often use EDI payments to pay for goods and services from suppliers and to process employee payroll payments.

Healthcare

EDI payments are frequently used in the healthcare industry to facilitate the exchange of payment information between healthcare providers and payers, such as insurance companies.

Government

Many government agencies use EDI payments to facilitate the exchange of payment information with vendors and contractors.

Financial services

Financial institutions and other businesses in the financial services industry often use EDI payments to process transactions and transfer funds between parties.

5 Benefits of Using EDI For Payment Processing

1. Efficiency: EDI payments can be processed automatically, which reduces the need for manual intervention and helps to streamline the payment process. This can save time and reduce the risk of errors.

2. Accuracy: EDI payments are less prone to errors than manual payment methods, as the information is transmitted electronically rather than entered manually. This can help to reduce the risk of fraud and ensure that payments are made accurately and on time.

3. Cost savings: EDI payments can help to reduce the costs associated with processing payments, as they eliminate the need for paper-based processes and can be transmitted electronically at a lower cost than traditional payment methods.

4. Improved cash flow: EDI payments can help to improve cash flow by enabling faster payment processing and reducing the risk of errors or delays. This can help businesses to manage their finances more effectively.

5. Improved relationships with suppliers: EDI payments can help businesses to maintain good relationships with their suppliers by making timely and accurate payments. This can help to strengthen the overall supply chain and encourage supplier loyalty

Other Advantages of Using EDI Payments

Financial Advantages

Reduced Processing Costs: Electronic payment processing costs 80-90% less than paper check processing, which averages $4-$20 per check.

Accelerated Cash Flow: Payments settle 2-5 days faster on average, improving working capital utilization.

Discount Capture: Automated processing enables more consistent capture of early payment discounts, typically worth 1-2% of invoice value.

Fraud Reduction: Electronic payments with proper controls reduce fraud risk by eliminating paper checks, which are vulnerable to tampering and forgery.

Operational Improvements

Streamlined Reconciliation: Automatic matching of payments with invoices reduces reconciliation time by 70-80%.

Error Reduction: Automated data flow eliminates manual entry errors in payment processing.

Staff Productivity: Accounting teams spend 75% less time on payment processing, allowing focus on higher-value activities.

Payment Visibility: Real-time tracking of payment status improves financial planning and supplier communications.

Strategic Benefits

Improved Supplier Relationships: Timely, accurate payments with detailed remittance information enhance vendor satisfaction.

Enhanced Analytics: Comprehensive payment data enables better spend analysis and cash flow forecasting.

Scalability: Electronic payment systems easily accommodate growing transaction volumes without proportional staff increases.

Environmental Impact: Eliminating paper checks and remittance documents reduces environmental footprint.

Integration with Other EDI Processes

EDI payments represent a crucial component in the procure-to-pay and order-to-cash cycles, integrating seamlessly with other EDI transactions:

Procure-to-Pay Integration

Purchase Order (EDI 850) initiated by buyer

PO Acknowledgment (EDI 855) returned by supplier

Advance Ship Notice (EDI 856) sent when goods ship

Invoice (EDI 810) submitted for payment

Payment Order/Remittance (EDI 820) completing the cycle

This integration ensures complete document traceability throughout the procurement process, with each transaction linked to create a comprehensive audit trail.

Order-to-Cash Integration

From the supplier perspective, the integration follows a parallel path:

Purchase Order (EDI 850) received from customer

PO Acknowledgment (EDI 855) sent to confirm

Shipping Notice (EDI 856) issued with shipment

Invoice (EDI 810) submitted for payment

Payment Receipt (EDI 820) closing the cycle

The most significant benefit of this integration is the automatic reconciliation between original orders, deliveries, invoices, and payments, dramatically reducing exceptions and discrepancies.

Research by Paystream Advisors found that organizations with fully integrated EDI payment solutions reduce invoice exceptions by 66% and payment errors by 37% compared to organizations using stand-alone payment systems.

Security and Compliance Considerations

EDI payments involve sensitive financial information, making security and compliance paramount concerns:

Security Protocols

Encryption: Advanced encryption standards protect data both in transit and at rest.

Authentication: Multi-factor authentication ensures only authorized users can initiate or approve payments.

Segregation of Duties: System controls prevent any single individual from creating and approving payments.

Audit Trails: Comprehensive logging of all payment activities creates accountability and traceability.

Regulatory Compliance

EDI payment systems must adhere to various regulations, including:

Sarbanes-Oxley (SOX): Requirements for internal controls over financial reporting.

Payment Card Industry Data Security Standard (PCI DSS): Standards for handling payment card information.

NACHA Operating Rules: Regulations governing ACH transactions.

International Regulations: Compliance with region-specific requirements like SEPA in Europe.

According to the Association of Certified Fraud Examiners, organizations with automated payment controls experience 54% lower fraud losses compared to those relying on manual processes, highlighting the security advantages of properly implemented EDI payment systems.

Difference Between EDI, ACH, and EFT

Often EDI (electronic data interchange), EFT (electronic funds transfer), and ACH (automated clearing house) are mistaken as similar processes, but they can be used together to facilitate the payment information and the payment. So, while EDI helps exchange bank details, payee names, and other important details, EFT is an act that protects consumer rights and defines the bank’s responsibilities to monitor electronic fund transfers. And ACH is a type of electronic payment under EFT that you can use to make a payment between banks

EDI

ACH

EFT

EDI (Electronic Data Interchange) is a standardized way of exchanging business data electronically between organizations. It is often used to facilitate transactions such as payments, invoicing, and orders.

One way that EDI is used for payments is by allowing organizations to send payment instructions and remittance information electronically, rather than through paper documents or manual data entry. This can help to streamline the payment process, reduce errors, and improve efficiency.

For example, a supplier may send an EDI invoice to a customer using an EDI format, such as an ANSI X12 810 Invoice. The customer can then process the invoice and generate a payment through their financial system using EDI. The payment can be sent to the supplier through EDI, along with any necessary remittance information, such as the payment amount and details of any deductions or adjustments.

EDI can also be used to automate the reconciliation of payments and invoices, as the payment and invoicing information is exchanged in a standardized format that can be easily processed by financial systems. This can help to reduce the time and effort required to reconcile payments and invoices and can improve the accuracy of financial reporting.

Overall, the use of EDI for payments can help to improve the efficiency and accuracy of financial transactions between organizations

ACH is a network that facilitates the transfer of funds between financial institutions. ACH payments refer to the use of this network to process electronic payments, such as direct deposits, bill payments, and e-checks

An Automated Clearing House (ACH) is a payment system that processes electronic financial transactions in the United States. It is operated by the National Automated Clearing House Association (NACHA) and is used to facilitate the transfer of funds between banks and other financial institutions.

ACH transactions include direct deposit of payroll, Social Security, and pension payments, as well as electronic bill payments and other types of electronic payments. ACH transactions are typically faster and more secure than paper-based transactions, and they can be initiated by businesses, financial institutions, and individuals.

To initiate an ACH transaction, a sender provides the necessary information to their financial institution, including the recipient’s name, bank account number, and routing number. The financial institution then sends the transaction to the ACH network, which processes the transaction and transfers the funds to the recipient’s account.

ACH transactions are settled in batches, typically at the end of the business day. This means that the funds may not be available in the recipient’s account until the next business day, depending on the timing of the transaction and the policies of the financial institutions involved.

EFT is a general term that refers to any electronic transfer of funds. This can include ACH payments, wire transfers, and other types of electronic payments

An electronic funds transfer (EFT) is a type of financial transaction that involves the transfer of funds from one bank account to another, typically through electronic means such as a computer or mobile device. EFTs can be used to transfer money between individuals or to make payments to businesses and organizations.

There are several types of EFTs, including:

- Automated Clearing House (ACH) transactions: ACH transactions are electronic payments that are processed through the National Automated Clearing House Association (NACHA). They include direct deposit of payroll, Social Security, and pension payments, as well as electronic bill payment and other types of electronic payments.

- Wire transfers: A wire transfer is a type of EFT that allows funds to be transferred between financial institutions in different locations. Wire transfers are typically used for large or time-sensitive transactions, as they are typically faster than ACH transactions.

- Electronic checks: An electronic check is a type of EFT that is initiated when a payer authorizes their financial institution to debit their account and transfer the funds to the payee’s account. Electronic checks are often used for bill payment and other types of recurring payments.

Common EDI X12 Transaction Types Used by Banking and Other Finance Industry

EDI X12 Transaction Number | EDI Transaction Name / Document Type |

Invoice | |

Payment Order/Remittance Advice | |

Purchase Order | |

Advance Ship Notice / Manifest | |

Shipment and Billing Notice | |

EDI 135 | Student Loan Application |

EDI 139 | Student Loan Guarantee Result |

EDI 144 | Student Loan Transfer and Status Verification |

EDI 146 | Request for Student Educational Record (Transcript) |

EDI 147 | Response to Request for Student Educational Record (Transcript) |

EDI 188 | Educational Course Inventory |

EDI 189 | Application for Admission to Educational Institutions |

EDI 190 | Student Enrollment Verification |

EDI 191 | Student Loan Pre-Claims and Claims |

EDI 194 | Grant or Assistance Application |

Affordable and Top EDI Solution Provider in North America

For over 35 years, Commport Communications has been providing the most affordable and best EDI solutions in the market. By helping companies solve complex integration issues and providing complete EDI communication between business partners.

Commport EDI integration experts can manage all the EDI and B2B integration processes for you, with the flexibility and scale that you truly need. Regardless of how you move your EDI files, Commport will always make sure that you have full access to all your data in real time, including web-based dashboards, transaction reports, and automated alerts.

Improve your business process and maximize your supply chain performance with our EDI solutions. Contact us today for a free consultation and demo.

Ready to find out more about Commport EDI Solutions?

Need Help? Download: EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI payments refer to the use of EDI to facilitate the exchange of payment information between two parties

To get started with EDI payments, an organization will need to implement an EDI system and establish connections with trading partners who also use EDI. This may require the investment in software and other resources, as well as training for employees.

Yes, any organization can use EDI for payments. Some of the common industries which make use of EDI payments are manufacturing, retail, healthcare, government, and financial services

Using EDI for payments can help to improve the efficiency and accuracy of financial transactions between organizations. It can also reduce the time and effort required to reconcile payments and invoices, and can improve the accuracy of financial reporting.

EDI allows organizations to send payment instructions and remittance information electronically, rather than through paper documents or manual data entry. This can help to streamline the payment process and reduce errors.

An Automated Clearing House (ACH) is a payment system that facilitate the transfer of funds between banks and other financial institutions.

An electronic funds transfer (EFT) is a type of financial transaction that involves the transfer of funds from one bank account to another this can include ACH payments, wire transfers, and other types of electronic payments