Introduction

Across today’s globalized e-commerce landscape, efficiently managing large-scale transactions has become essential for business survival. Manual processing creates bottlenecks, increases errors, and slows down your entire transaction cycle – ultimately hurting both your customer relationships and cash flow.

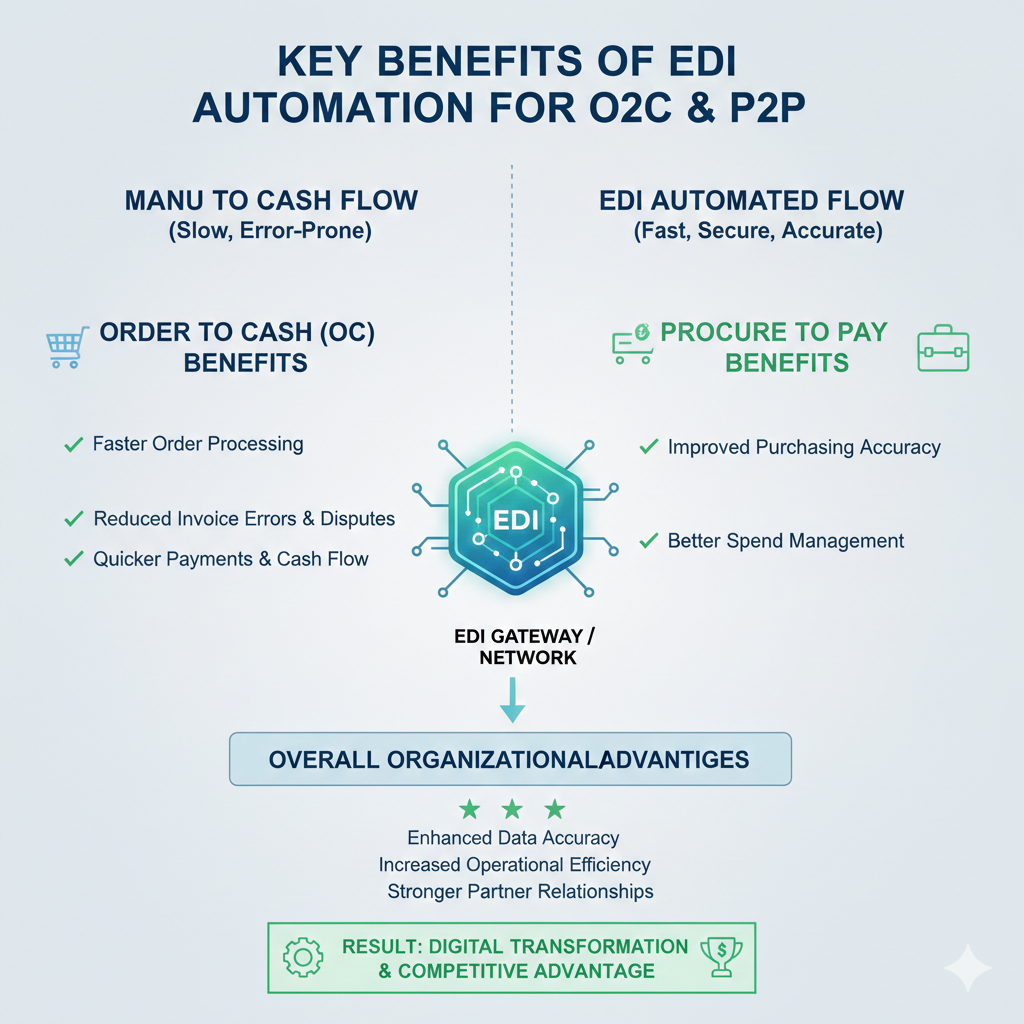

This is where EDI solutions help transform both your Order-to-Cash and Procure-to-Pay workflows. By automating key steps from order receipt to payment, businesses can speed up order fulfillment, optimize cash flow, and significantly reduce administrative costs. Meanwhile, a comprehensive procure-to-pay solution ensures compliance, reduces manual tasks, and increases savings across vendor management.

In this blog, we’ll explore how EDI simplifies both O2C and P2P processes, the specific benefits for each workflow, and how automation ensures you can handle high transaction volumes without a proportional rise in operating costs. Let’s dive into how these solutions can streamline your business operations!

Key Takeaways

- Dramatic cost reduction: EDI cuts transaction costs by 35% and reduces the cost per order from $38 to just $1.35 through automation

- Speed acceleration: Order processing time decreases by 75%, with P2P cycles shortened from 7-10 days to just 1-3 days

- Error elimination: Data entry errors are reduced by 40%, virtually eliminating costly mistakes that plague manual systems

- Real-time visibility: Instant tracking of orders, shipments, and payments enables proactive management and faster decision-making

- Enhanced compliance: Automated audit trails improve regulatory adherence by 80%, ensuring effortless compliance during audits

Understanding Order to Cash and Procure to Pay Processes

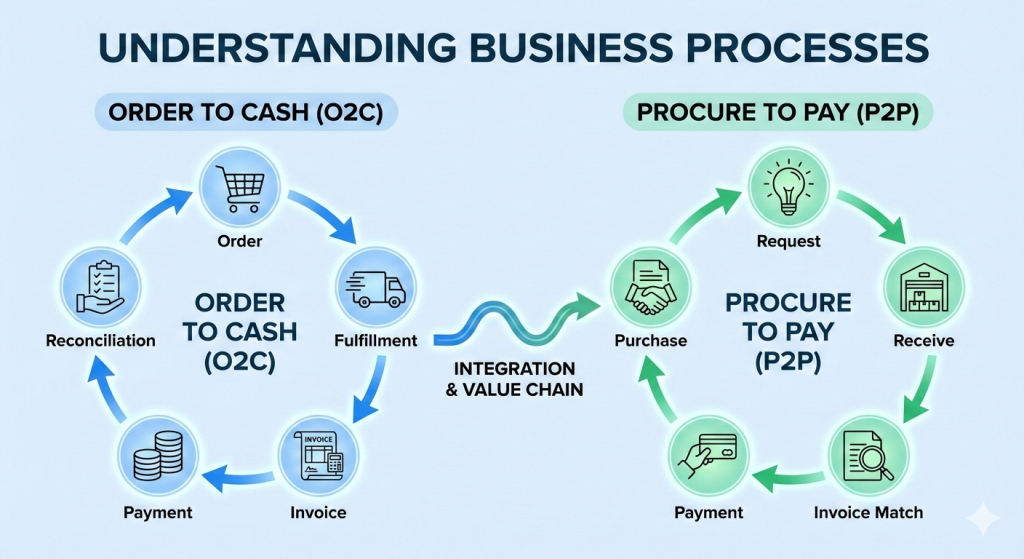

Every business operation relies on two critical financial workflows that manage the inbound and outbound flow of goods, services, and payments. Before examining how EDI transforms these processes, let’s understand their fundamental mechanics.

What is the Order to Cash Process

The Order to Cash (O2C) process encompasses the entire customer ordering journey from initial order placement through payment collection. This end-to-end cycle begins when a customer places an order and concludes in your financial system. The comprehensive O2C workflow includes order management, fulfillment, shipping, invoicing, payment collection, and financial recording, essentially forming the revenue-generating backbone of any business when payment is successfully recorded

What is the Procure to Pay Process

Conversely, the Procure to Pay (P2P) process manages how an organization acquires the goods and services it needs.

The P2P workflow typically involves needs identification, requisition creation, purchase order management, goods receipt verification, invoice processing, and payment disbursement.

For this reason, P2P primarily focuses on expenditure management rather than revenue generation, which ends with vendor payment

Key Differences Between O2C and P2P

At this point, you might wonder how these processes differ. The fundamental distinction is in their direction and focus: O2C manages customer-facing sales activities and incoming revenue, while P2P handles supplier-facing purchasing activities and outgoing payments. In contrast to O2C’s concentration on sales order fulfillment and cash inflow, P2P deals with procurement activities and cash outflow—making them complementary yet distinct operational workflows.

Common Challenges in Manual O2C and P2P Workflows

Without automation, both processes face significant obstacles:

- Data silos and fragmentation cause disconnects between systems, requiring time-consuming reconciliations

- Manual data entry introduces errors that propagate through the entire workflow

- Limited visibility across transactions prevents effective monitoring and optimization

- Delayed anomaly detection means errors are often discovered too late, during the month-end close or audits

These challenges ultimately result in cash flow delays, revenue leakage, increased operational costs, and strained relationships with both customers and suppliers.

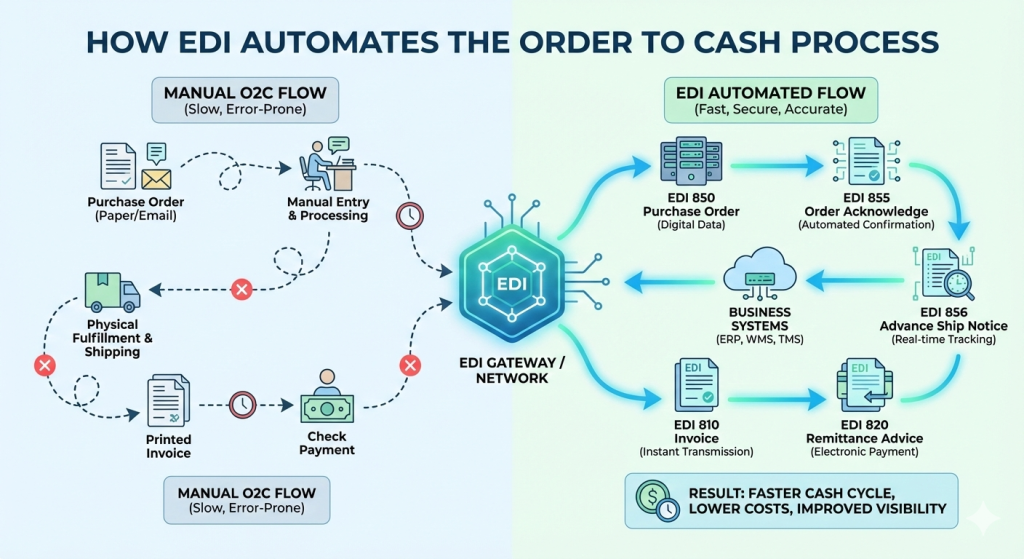

How EDI Automates the Order to Cash Process

Traditional order-to-cash workflows without automation can cost businesses . EDI technology transforms these costly manual processes into streamlined, digital workflows that dramatically improve efficiency across your entire revenue cycle, approximately $38 per order

1. Automating Order Processing with EDI

EDI order processing replaces paper documents, phone calls, emails, and faxes with seamless electronic data exchange between trading partners. This automation eliminates error-prone manual data entry, allowing purchase orders to flow directly into your ERP or order management system without human intervention. For businesses processing high volumes, this automation translates to substantial time savings some companies have reduced order processing time by 75%

2. Streamlining Invoicing and Payment Collection

Once orders are fulfilled, EDI continues automating the revenue cycle through electronic invoicing. EDI invoicing software generates and delivers invoices instantly through customers’ preferred channels, accelerating the entire payment collection process. Furthermore, automated remittance advice exchange ensures payments are recorded accurately and reconciled instantly, allowing businesses to recognize revenue faster.

3. EDI Documents for Order to Cash Automation

A typical EDI order-to-cash process involves several standardized transaction types:

- EDI 850 (Purchase Order): Received from the customer to initiate the order cycle

- EDI 855 (Purchase Order Acknowledgment): Confirms receipt and processing status

- EDI 856 (Advanced Shipping Notice): Provides shipment details before delivery

- EDI 810 (Invoice): Electronically requests payment after order fulfillment

- EDI 820 (Payment Order): Confirms payment details and serves as payment intent

4. Improving Cash Flow with O2C Automation Software

Modern O2C automation software integrates with EDI to provide real-time visibility into the entire order-to-cash cycle. This transparency enables better decision-making and process optimization, ultimately accelerating cash flow. Additionally, EDI invoicing speeds up payment processing, reducing the invoice-to-payment cycle time. The financial impact is substantial; some businesses have reduced their cost per order from $38 to just $1.35 through EDI implementation.

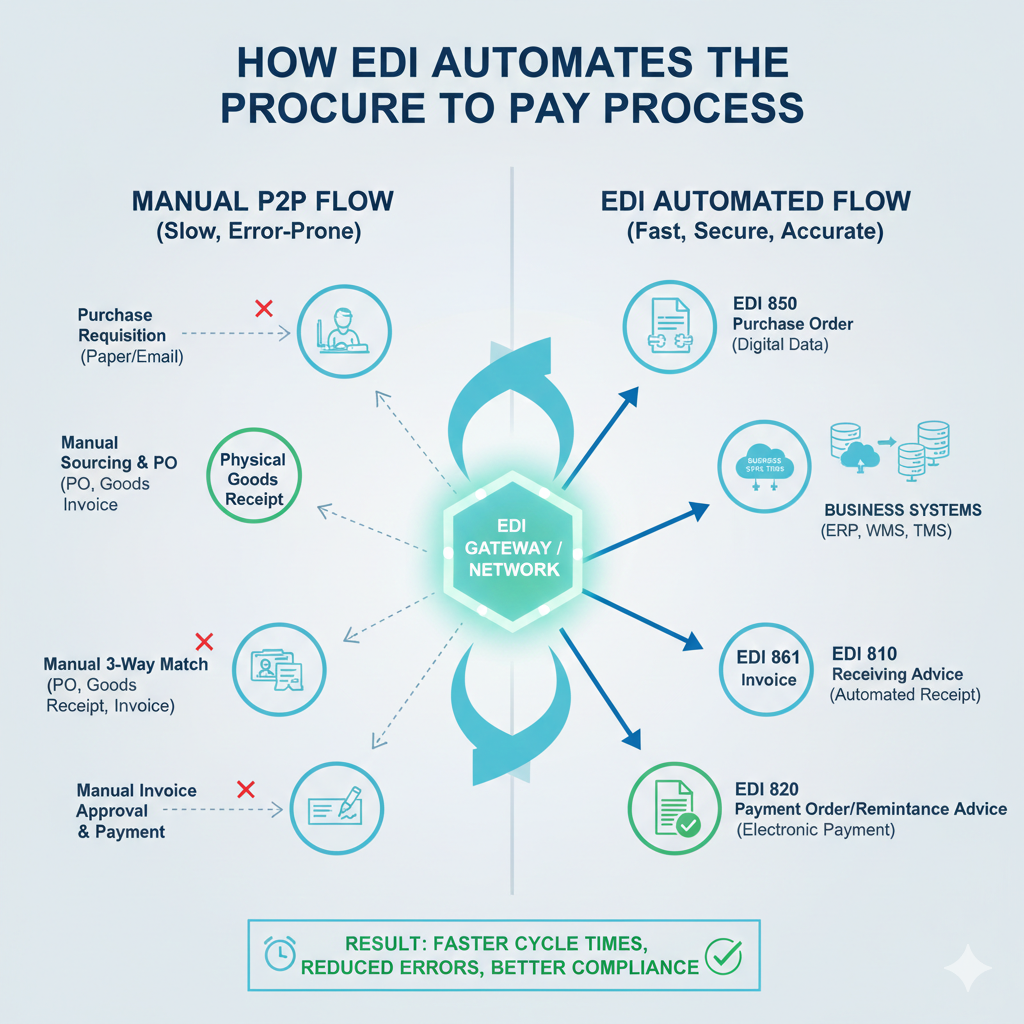

How EDI Automates the Procure to Pay Process

The traditional procure-to-pay cycle typically requires 7-10 days to complete, involving numerous manual steps and potential errors. Through EDI implementation, however, this same process can be executed in just a few days, creating a dramatically more efficient purchasing workflow in 1-3 days

1. Automating Purchase Order Management

EDI transforms the purchase order process by eliminating time-consuming manual entry. Once inventory levels drop below predetermined thresholds, an EDI-enabled system automatically detects the need for replenishment and generates purchase requests. After approval, purchase orders are instantly created and electronically transmitted to suppliers. This automation prevents data entry errors that frequently plague manual processes. Subsequently, suppliers can electronically acknowledge receipt, confirm pricing, quantities, and expected delivery dates, all without human intervention.

2. Streamlining Invoice Matching and Payment

Upon delivery of goods, EDI facilitates the critical validation process. This automated procedure compares purchase orders, delivery receipts, and supplier invoices to verify that payments are made only for accurately ordered and received items. As suppliers submit electronic invoices, optical character recognition (OCR) technology extracts key details, enabling the system to automatically validate and approve legitimate invoices. This automation significantly reduces payment delays, disputes, and potential fraud. three-way matching

3. EDI Documents for Procure to Pay Solution

Several standardized EDI transaction types power the P2P process:

- EDI 840 (Request for Quotation): Initiates supplier inquiries

- EDI 850 (Purchase Order): Officially places the order

- EDI 855 (Purchase Order Acknowledgment): Confirms receipt and acceptance

- EDI 856 (Advance Ship Notice): Provides shipment details

- EDI 810 (Invoice): Requests payment for delivered goods

- EDI 820 (Payment Order): Confirms payment execution

4. Reducing Manual Tasks in P2P Workflows

Perhaps most importantly, EDI automation eliminates repetitive tasks throughout the P2P cycle. Instead of employees manually entering data, EDI enables direct system-to-system communication. This drastically reduces processing time while virtually eliminating keystroke errors and reprocessing costs. Moreover, the electronic nature of all documents creates an automatic audit trail, ensuring payment verification occurs accurately and completely. Through this comprehensive automation, organizations gain improved visibility, enhanced compliance, and the ability to reallocate staff from routine data entry to higher-value activities like customer service.

Key Benefits of EDI for O2C and P2P Automation

Organizations report five critical advantages after implementing EDI across their financial workflows. Commport EDI Solutions helps you automate all your EDI transactions. Trusted by 6000+ happy customers. 40+ years of industry experience.

1. Faster Transaction Processing and Reduced Errors

EDI automation dramatically accelerates transaction cycles while improving accuracy. Companies typically reduce their order processing time by 75%, turning days-long processes into minutes. Furthermore, EDI implementation reduces data entry errors by 40%, virtually eliminating costly mistakes that plague manual systems.

2. Real-Time Visibility Across Business Processes

Through EDI, businesses gain instant access to crucial financial data across both O2C and P2P workflows. This transparency enables stakeholders to track orders, shipments, and payments in real-time, allowing for proactive management and prompt issue resolution.

3. Lower Operating Costs and Improved Efficiency

The financial impact of EDI implementation is substantial:

- Transaction costs reduced by 35%

- Total savings of 800 million euros annually across O2C and P2P processes

- Order-to-cash cycle time shortened by over 20%

4. Better Supplier and Customer Relationships

EDI standardizes communication between trading partners, eliminating format discrepancies that cause delays. This streamlined interaction strengthens business relationships, enabling faster shipping and more competitive pricing.

5. Enhanced Compliance and Audit Trails

EDI automatically generates comprehensive audit trails for all electronic transactions, creating 80% improved compliance. These detailed records track every activity throughout the process, ensuring effortless regulatory adherence during audits.

Conclusion

Implementing EDI automation transforms both Order to Cash and Procure to Pay processes from manual, error-prone workflows into streamlined, efficient operations. Therefore, businesses can expect significant improvements across their financial cycles, with transaction costs reduced by 35% and order processing time cut by an impressive 75%. Additionally, the elimination of data entry errors creates a ripple effect of benefits throughout the entire organization.

Real-time visibility stands as another compelling reason to adopt EDI solutions. Without question, the ability to track orders, shipments, and payments as they happen enables proactive management and faster decision-making. This transparency not only improves internal operations but also strengthens relationships with trading partners through standardized, error-free communications.

The financial impact cannot be overstated. Most importantly, businesses that implement EDI automation can reduce their cost per order from $38 to just $1.35 while shortening their order-to-cash cycle time by over 20%.

We should remember that EDI automation creates value beyond mere cost savings. Enhanced compliance, detailed audit trails, and 80% improved regulatory adherence provide peace of mind during audits. After all, the ability to scale transaction volumes without proportionally increasing operating costs gives businesses a competitive edge in today’s fast-paced market.

The future of business transactions clearly belongs to automated, efficient processes. Companies that embrace EDI automation for their O2C and P2P workflows will undoubtedly position themselves for greater profitability, stronger trading partner relationships, and sustainable growth in an increasingly digital business environment.

Commport EDI Solutions - #1 EDI Solutions in North America

Need Help? Download: Commport's EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently asked Questions

EDI automates the entire Order to Cash cycle, from order receipt to payment collection. It eliminates manual data entry, reduces errors, and speeds up transaction processing. This automation can cut order processing time by up to 75% and reduce costs from $38 to $1.35 per order.

EDI implementation in Procure to Pay processes offers several benefits, including faster transaction processing, reduced errors, real-time visibility across business processes, lower operating costs, and enhanced compliance. It can shorten the P2P cycle from 7-10 days to just 1-3 days.

Common EDI documents used in the Order to Cash process include EDI 850 (Purchase Order), EDI 855 (Purchase Order Acknowledgment), EDI 856 (Advanced Shipping Notice), EDI 810 (Invoice), and EDI 820 (Payment Order). These standardized transaction types facilitate seamless electronic data exchange between trading partners.

EDI improves cash flow by accelerating the entire revenue cycle. It speeds up order processing, streamlines invoicing, and expedites payment collection. Real-time visibility into the order-to-cash cycle enables better decision-making and process optimization, ultimately reducing the invoice-to-payment cycle time and improving overall cash flow.

EDI standardizes communication between trading partners, eliminating format discrepancies that can cause delays. This streamlined interaction strengthens business relationships by enabling faster shipping, more competitive pricing, and reducing errors in transactions. It also provides real-time visibility, allowing for proactive management and prompt issue resolution.