Introduction

EDI chargebacks cost businesses hundreds to thousands of dollars per violation, creating a significant revenue drain that many companies don’t track properly. In 2020 alone, 66% of businesses reported losing up to $500,000 due to poor EDI integrations, with some companies facing losses exceeding $1 million.

What’s even more concerning is that 26% of businesses aren’t sure how many orders they’ve lost due to EDI issues. Becoming EDI compliant isn’t just a technical requirement—it’s essential for your financial health. Approximately 60% of B2B transactions face disruptions due to data anomalies, which often trigger these costly penalties. Major retailers like Walmart, Amazon, and Target have particularly strict EDI requirements, issuing chargebacks for everything from late ASNs to incorrect invoice data and noncompliant packaging.

In this guide, we’ll walk through everything you need to know about EDI compliance in simple terms. We’ll explain how to identify potential chargeback triggers, understand key EDI requirements, and implement practical strategies to stop losing money through these preventable penalties.

What Are EDI Chargebacks and Why Do They Hurt Your Business

Define EDI Chargebacks

EDI chargebacks are financial penalties (often called “expense offsets”) that trading partners impose when you don’t comply with their EDI requirements. Retailers and other trading partners issue these penalties because your non-compliance disrupts their operations and creates additional expenses for them.

For example, if you send documents with incorrect formatting, ship products with mismatched data, or miss transmission deadlines, you’ll likely trigger a chargeback. The painful truth is that while these penalties were initially designed to recover costs, they’ve evolved into significant profit centers for many customers.

How much can these penalties cost? A $100 charge for a single EDI document containing errors is not uncommon. The actual amount varies between trading partners, with penalties ranging from hundreds to literally thousands of dollars per violation. Most trading partners provide a chargeback fee schedule, but keeping track of these can be challenging since each customer’s deduction schedule differs.

What makes chargebacks especially problematic is how they’re collected—typically deducted directly from your payment checks. This means the money is gone before you even have a chance to dispute it.

Several factors make EDI chargebacks difficult to manage:

- Frequency of changes: Vendor manuals and routing guides update regularly

- Complexity: Sometimes hundreds of chargebacks occur, some too small to investigate

- Cross-department impact: Managing chargebacks requires coordination across logistics, accounts receivable, accounts payable, and sales teams

The hidden costs beyond the penalty fees

The direct financial penalties of EDI chargebacks are just the beginning of their impact. In a recent survey, 66% of respondents reported losing up to $500,000 in 2020 due to poor EDI integrations, compared to 43% losing that amount the year before. Furthermore, 8% lost between $500,000 and $1,000,000, while 10% estimated losses exceeding $1,000,000.

Alarmingly, 26% of respondents couldn’t even tell how many orders they lost. This points to a broader issue—many businesses aren’t effectively tracking the full impact of their EDI non-compliance.

Beyond the immediate financial hit, chargebacks create several hidden costs that can significantly harm your business:

First, investigating and resolving chargebacks diverts valuable resources from your core business activities. Your team must review documentation, communicate with retailers, and prepare evidence for disputes instead of focusing on growth initiatives.

Second, frequent chargebacks damage trust between you and your retail partners. Retailers might view high chargeback rates as a sign of unreliability, potentially leading to stricter oversight, reduced shelf space, or even relationship termination.

Third, your brand reputation suffers, which can lead to negative reviews and decreased consumer trust. Retailers closely monitor your performance through scorecards that always include chargeback metrics. Poor scorecard performance often results in fewer promotional opportunities, delayed payments, or harsher payment terms.

Finally, addressing non-compliance issues often necessitates operational changes, such as upgrading systems or retraining staff—all adding to your overall costs.

While individual chargebacks might seem manageable, their cumulative effect can devastate your profitability and growth potential. Each dollar lost to a chargeback can ultimately cost up to $4.41 when accounting for all related expenses. Consequently, understanding and preventing EDI chargebacks becomes essential for maintaining healthy business operations and partnerships.

How Small EDI Mistakes Turn Into Big Chargebacks

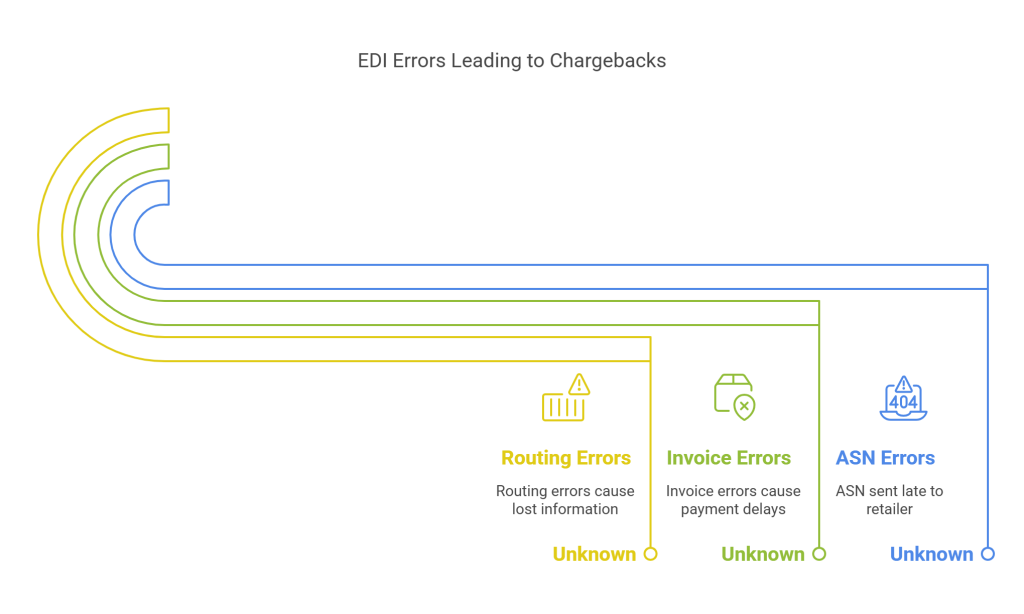

In the world of retail partnerships, seemingly minor EDI mistakes can quickly escalate into costly chargebacks that drain your revenue. These technical hiccups might appear insignificant at first glance, nonetheless, they create significant disruptions in your trading partners’ operations, prompting them to issue financial penalties.

1. Late or missing ASNs

Advanced Shipping Notices (ASNs) represent one of the most common triggers for EDI chargebacks. Best business practice requires transmitting your ASN within two hours of finalizing a shipment. If your ASN doesn’t arrive before the physical goods, you’re almost guaranteed a chargeback.

The timing challenge is real—ASNs must be sent after the shipment is sealed (representing actual contents), yet arrive before the shipment is received. This delicate balance gets disrupted by several factors:

- Unsynchronized master data between your system and your retailer’s

- Changes in systems or supplier personnel

- Last-minute order adjustments due to stock shortages or damaged goods

- Technical failures like EDI mapping errors

The financial impact extends beyond the immediate penalty. Late ASNs prevent retailers from preparing for upcoming deliveries, creating inventory management disruptions, and potentially affecting their customer satisfaction. This domino effect often results in steeper penalties and strained relationships.

2. Incorrect invoices or shipping labels

Invoice and ASN discrepancies trigger another major category of EDI chargebacks. When the information about shipped goods doesn’t match what appears on the invoice, disputes arise, leading to delayed payments and additional penalties.

Common errors include:

- Incorrect quantities or wrong product codes

- Missing mandatory fields or insufficient product descriptions

- Data validation failures from incomplete information

- Mismatched data between purchase orders, shipping notices, and invoices

These discrepancies create inventory inconsistencies that ripple throughout the supply chain. Moreover, they require manual intervention to resolve, precisely what EDI was designed to eliminate. Each manual correction costs your trading partner time and money, which they recoup through chargebacks.

3. Packaging and routing errors

Routing errors occur when data elements in the sender and receiver systems fail to match, resulting in lost or misinterpreted information. Meanwhile, packaging errors typically involve non-compliance with specific carton configurations requested by retailers.

Several factors contribute to these issues:

- Inaccurate or incomplete routing instructions due to data entry errors

- Non-compliance with specified routing instructions

- Technical failures, including software bugs or network outages

- Configuration errors from missing setups in your ERP system

Additionally, retailers often have specific packaging requirements. When last-minute additions or substitutions occur, you need processes for adjusting the ASN accordingly and reprinting labels. Without these systems, packaging compliance issues multiply.

Each category of error generates multiple opportunities for chargebacks. To achieve EDI compliance, you must identify where your processes are vulnerable. The key to becoming EDI compliant lies in understanding that these aren’t just technical problems—they’re business process challenges requiring systematic solutions focused on timeliness, accuracy, and completeness of your EDI communications.

Common EDI Requirements You Must Know

Preventing EDI chargebacks starts with understanding exactly what your trading partners require from you. After working with hundreds of businesses on their EDI implementations, I’ve found that most compliance failures stem from misunderstanding a few critical requirements.

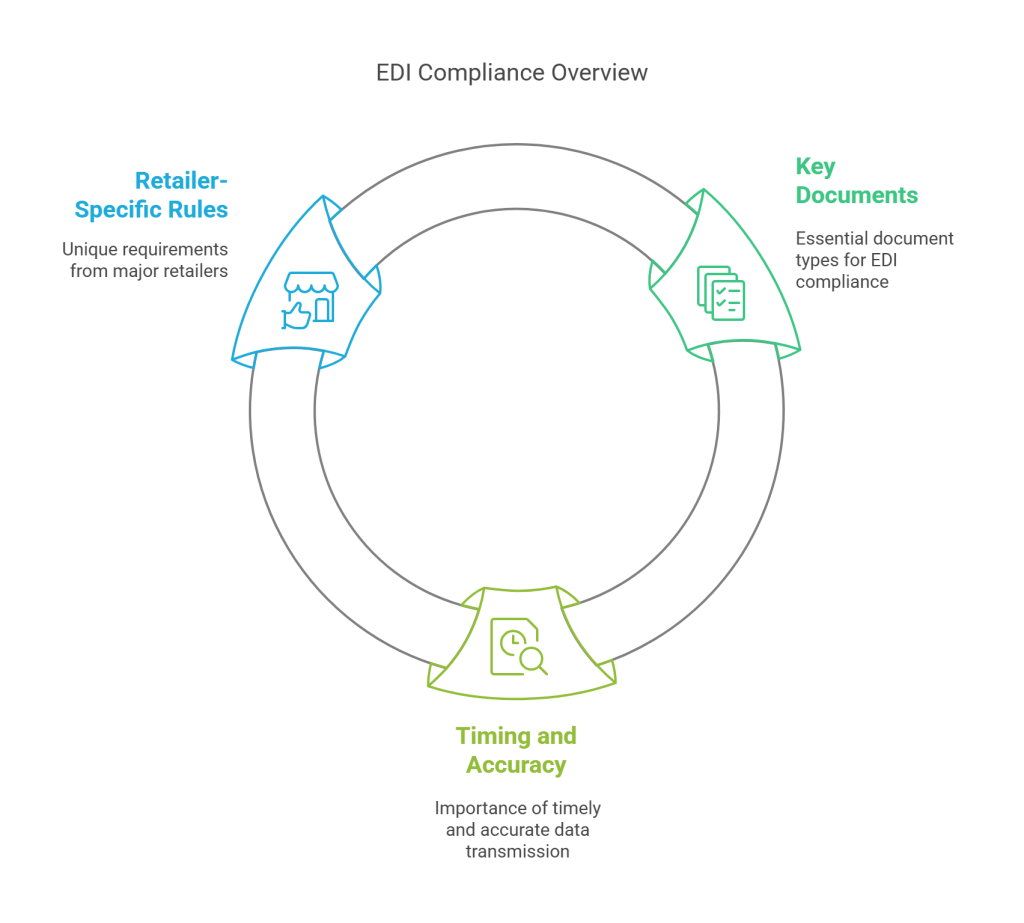

1. Key documents like ASN, PO, and Invoice

The foundation of EDI compliance rests on three essential document types that retailers prioritize:

Purchase Order (EDI 850) serves as the starting point for most transactions. This document contains critical details including item descriptions, quantities, pricing, payment terms, discounts, and requested delivery dates. Major retailers expect you to acknowledge receipt through an Order Acknowledgment (EDI 855), confirming whether you can fulfill the order as requested.

Advanced Shipping Notice (EDI 856) might be the most crucial document for preventing chargebacks. The ASN provides detailed information about upcoming shipments, including package contents, tracking numbers, carrier details, and estimated delivery dates. Research shows electronic ASNs can reduce receiving times by up to 60%, with a 250-store company potentially saving 65,000 receiving hours annually when just 25% of deliveries use automated ASNs.

Invoice (EDI 810) completes the transaction cycle, requesting payment for delivered goods or services. Invoices must contain precise item details, quantities, pricing, and payment terms that align perfectly with your purchase order and ASN.

2. Timing and accuracy expectations

The timing of EDI transmissions is equally important as their content. Generally, your trading partners expect:

- ASNs are transmitted within two hours of shipment completion

- Order acknowledgments sent within 24 hours of receiving purchase orders

- Functional acknowledgments (EDI 997) returned within 24 hours

Accuracy requirements extend beyond simply having the right information—your data must follow standardized formats like ANSI X12 (North America) or EDIFACT (international). These EDI standards ensure all trading partners can interpret your data correctly, as they govern document structure, syntax rules, and identification values.

3. Retailer-specific rules to watch for

Although standard EDI principles apply broadly, major retailers implement unique requirements that demand special attention:

Walmart, certainly one of the strictest retailers, requires vendors to maintain consistent AS2 connections and complete EDI testing within six weeks. Their basic document requirements include seven specific transaction types, with functional acknowledgments expected within 24 hours.

Amazon similarly enforces strict routing requirements, demanding that suppliers encode and submit routing requests within specific shipping windows. Products not delivered within the designated schedule must be returned.

Most retailers issue detailed routing guides or vendor manuals outlining their specific EDI requirements. These guides frequently update, so establishing a process to stay current with changes is essential for remaining EDI compliant.

Becoming familiar with these fundamental requirements provides the foundation for avoiding costly chargebacks that can quickly erode your profitability and strain trading partner relationships.

How to Become EDI Compliant and Stop Chargebacks Early

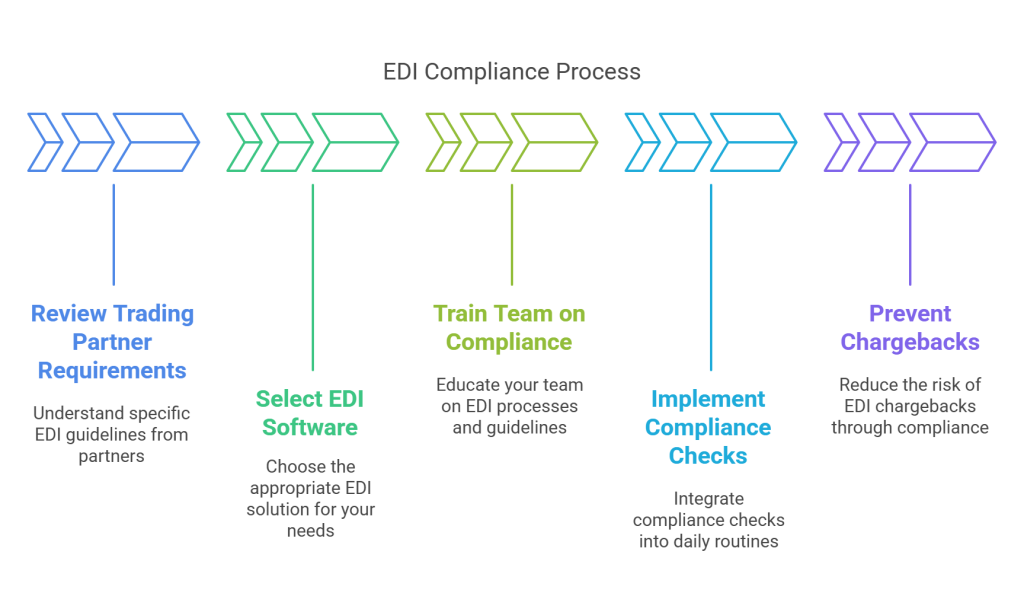

Taking proactive steps toward EDI compliance remains your best defense against costly EDI chargebacks. Rather than reacting to penalties after they occur, implementing these strategies will help you prevent them altogether.

1. Review and understand your trading partner’s EDI requirements

The first critical step in becoming EDI compliant is thoroughly reviewing your trading partners’ requirements documentation. Most major retailers provide detailed vendor guidelines on their websites. These documents outline:

- Acceptable EDI document formats and versions

- Communication protocols (like AS2 or VAN connections)

- Testing procedures and certification processes

- Specific timing requirements for document exchanges

During this review, pay close attention to retailer-specific rules. For instance, Walmart requires vendors to demonstrate capability with their entire basic document set within six weeks of beginning EDI testing. Failing this timeline could result in the termination of your trading relationship.

2. Use reliable EDI software and automation

Selecting the right EDI solution forms the foundation of your compliance strategy. Three main options exist, each suited to different business needs:

Cloud EDI works well for companies with low transaction volumes, offering basic compliance without significant investment.

Integrated EDI Solutions provides transaction integration between your systems and trading partners, letting you focus on business requirements while the solution provider manages EDI standards.

EDI Translation Software typically requires on-premise installation and dedicated staff with specialized knowledge.

A centralized EDI platform delivers particularly strong benefits, as it pre-loads hundreds of ready-to-deploy communication templates for major trading partners. This automation dramatically reduces human error, the primary cause of EDI chargebacks.

3. Train your team on compliance basics

Even with excellent software, your team needs proper training to maintain compliance. Regular updates on EDI processes and guidelines significantly reduce compliance risks.

Your training should cover:

- Document timing requirements (when ASNs, invoices, etc., must be sent)

- Data validation procedures to catch errors before transmission

- Problem-resolution protocols when issues arise

- Regular compliance audit procedures

Cross-disciplinary training proves especially valuable, as it creates teams better equipped to adapt to customer demands. Furthermore, integrating compliance checks into daily routines rather than treating them as final verification steps will proactively identify issues throughout your supply chain.

By implementing these three strategies—understanding requirements, selecting appropriate software, and training your team—you’ll establish a solid foundation for EDI compliance that prevents chargebacks before they occur.

Simple Tips to Stay EDI Compliant Every Day

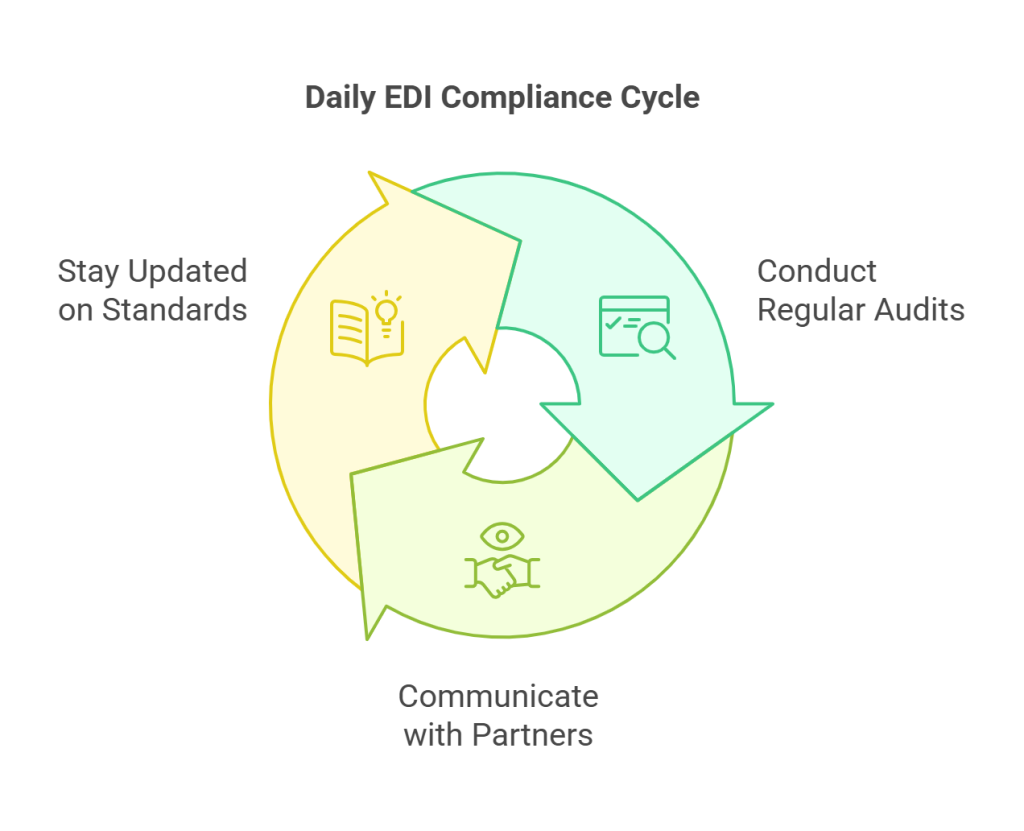

Maintaining EDI compliance isn’t a one-time achievement but an ongoing discipline requiring daily attention. Once you’ve established basic compliance, your focus must shift to consistency and vigilance to avoid those costly EDI chargebacks.

1. Set up regular audits and checks

Regular EDI audits form the backbone of ongoing compliance. Before conducting an audit, define its scope by identifying key areas like data integrity, system security, and partner-specific requirements. Effective audits should:

- Review compliance with relevant EDI standards and industry regulations

- Verify encryption protocols and secure communication channels

- Analyze data transmission accuracy through transaction sampling

- Measure system efficiency through transmission speed and error rates

Making compliance checks part of your daily operations—rather than a final verification step—helps proactively identify issues throughout your supply chain. Subsequently, implement automated monitoring wherever possible and schedule regular audits biannually to maintain system reliability.

2. Communicate often with trading partners

Good communication can make or break your EDI initiatives. Primarily, establish clear channels with trading partners to stay aligned with their requirements and operations. This approach not only supports compliance but also builds stronger business relationships that foster loyalty.

When evaluating EDI providers, consider how they’ll handle trading partner communications. A full-service provider should take ownership of these time-consuming tasks, communicating directly with your partners to manage connectivity, setup, and requirement updates on your behalf.

3. Stay updated on changes in EDI standards

Trading partners periodically revise their vendor guidelines, making it essential to monitor updates to avoid missed SLAs and costly fines. Straightaway, check partner portals where guidelines and updates are typically posted.

Data privacy and regulatory requirements evolve regularly, increasing scrutiny and potential penalties for non-compliance. Multiple regulations impact EDI practices, including GDPR, EFTA, and PCI DSS.

To minimize these risks, ensure your EDI system is equipped with robust security measures that comply with relevant regulations. Additionally, work closely with your trading partners to align security protocols across your supply chain, creating a more resilient compliance framework.

Conclusion

EDI chargebacks represent a significant financial threat that businesses must address proactively. Throughout this guide, we’ve seen how these penalties quickly add up, with 66% of businesses losing up to $500,000 annually due to poor EDI integration. Undoubtedly, the cost extends beyond direct penalties—damaging partner relationships, diverting resources, and ultimately harming your brand reputation.

Prevention starts with understanding the three critical EDI documents: Purchase Orders (850), Advanced Shipping Notices (856), and Invoices (810). Mistakes in these areas, particularly late ASNs or mismatched data, trigger most chargebacks. Therefore, mastering these fundamentals forms your first line of defense against costly penalties.

Becoming EDI compliant requires three essential strategies. First, thoroughly review your trading partners’ requirements documentation. Second, implement reliable EDI software that automates processes and reduces human error. Third, train your team on compliance basics and establish clear protocols for handling potential issues.

Maintaining compliance demands ongoing vigilance through regular audits, frequent communication with trading partners, and staying updated on changing standards. Most importantly, treating compliance as a daily practice rather than a one-time achievement will protect your business from unexpected charges.

Commport EDI Solutions - Affordable & Scalable Solutions in the Market

Need Help? Download: Commport's EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI chargebacks are financial penalties imposed by trading partners when a business fails to meet specific EDI requirements. They can significantly impact a company’s bottom line, with some businesses losing up to $500,000 annually due to poor EDI integration.

The most frequent triggers for EDI chargebacks include late or missing Advanced Shipping Notices (ASNs), incorrect invoices or shipping labels, and packaging and routing errors. These seemingly small mistakes can lead to significant disruptions in trading partners’ operations.

To prevent EDI chargebacks, businesses should thoroughly review their trading partners’ EDI requirements, use reliable EDI software for automation, and provide comprehensive training to their team on compliance basics. Regular audits and staying updated on EDI standards are also crucial.

The three essential EDI documents businesses must prioritize are Purchase Orders (EDI 850), Advanced Shipping Notices (EDI 856), and Invoices (EDI 810). Ensuring accuracy and timeliness in these documents is critical for maintaining EDI compliance.

It’s recommended that businesses conduct EDI audits bi-annually to maintain system reliability. However, implementing daily compliance checks as part of regular operations can help proactively identify issues throughout the supply chain and prevent chargebacks before they occur.