Introduction to EDI in Finance

In this new era of digitalization, the growth of international trade has created opportunities for trade between buyers and suppliers across the globe, resulting in the globalization of the financial supply chain. It involves many different processes to exchange information such as differences in currencies, accounting regulations, and other financial transactions/documents. Using EDI in the financial process mitigates this risk by automating the data exchange process in a standardized format, enabling the seamless, accurate, and timely exchange of financial data between buyers, sellers, and their financial institutions.

The most common EDI standard used in North America is EDI ANSI X12 transactions. There also other popular EDI standards are used across the world such as UN/EDIFACT, SWIFT, and more

EDI in the finance industry helps businesses, financial institutes, and governments with the seamless transmission of financial information on a massive scale by automating the entire transaction cycle and reducing the dependency on the manual labor-intensive process.

How EDI is used by the Finance Industry

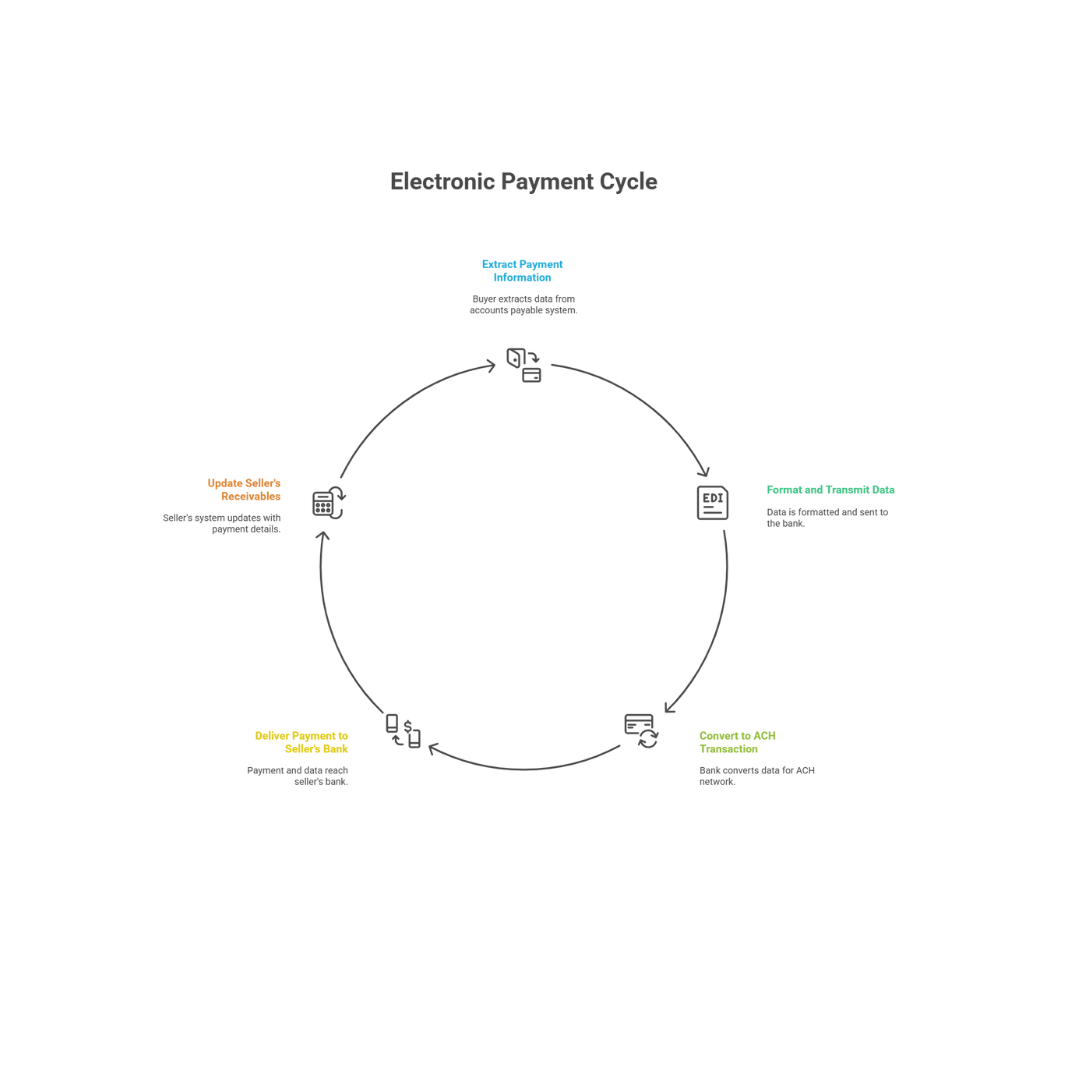

These are the few steps taken by a company or institution to exchange payments or payment-related information.

Step 1 – The buyer electronically extracts payment information from the organization’s account payable system

Step 2 – The data is formatted into an EDI standard. Then, the transaction set is transmitted to the organization’s bank

Step 3 – The bank formats that information into the format necessary for its transmission through the Automated Clearing House (ACH) network as an ACH transaction.

Step 4 – The ACH network delivers the payment and its associated data to the seller’s bank, with the bank crediting the seller.

Step 5- It automatically transmits the payment information to the seller’s account receivable system, where the seller can see the funds have been posted.

How EDI helps Streamline the Processes in Financial Industry

The financial industry such as banks and private financial institutions offers various financial services to both individuals and businesses some of those services include personal loans, mortgages, day-to-day banking services, credit cards, insurance, and many more. All these different services involve the processing of complex information in a standardized format such as the processing of payable and receivables, supporting post-trade security flows, transmitting settlement files, or enabling group benefits eligibility claims.

For many years these processes were completed using manual methods which often delayed the overall operations. However, with the adoption of EDI technology, all these processes were standardized and automated making it possible to exchange information in minutes and increasing overall operational efficiency, reducing transaction costs, and accuracy, and increasing customer satisfaction.

Benefits of EDI in the Financial Industry

Payment automation – Automate payments to suppliers/vendors, payroll processing, accounts payable/ receivable, and more

Highly secure & reduce errors – Securely exchange financial information between banks, suppliers, and trading partners. Reduce errors caused by manual data entry

Improve cash flow – EDI helps you collect your payments faster and more efficiently thus improving overall cash flow

Reduce data processing cost – EDI reduces the turnaround time to process the data by processing them electronically in a standardized format and exchanging information in minutes thus reducing the costs of manual data processing

Conclusion

The utilization of Electronic Data Interchange (EDI) in the finance industry represents a pivotal shift towards modernization and efficiency. By facilitating the electronic exchange of financial information, EDI streamlines processes, reduces manual errors, and enhances the speed and accuracy of transactions.

In the dynamic and fast-paced world of finance, EDI catalyzes improved communication among financial institutions, enabling them to adapt swiftly to market changes and regulatory requirements. The integration of EDI in the finance sector not only optimizes operational workflows but also fosters a more resilient, transparent, and collaborative financial ecosystem.

As the industry continues to embrace digital transformation, EDI remains a key enabler for financial institutions seeking to stay competitive and provide seamless services in the digital era.

Common EDI X12 Transactions Used in Finance Industry

EDI X12 Transaction Number | EDI Transaction Name / Document Type |

EDI 130 | Student Educational Record (Transcript) |

EDI 131 | Student Educational Record (Transcript) Acknowledgment |

EDI 135 | Student Loan Application |

EDI 139 | Student Loan Guarantee Result |

EDI 144 | Student Loan Transfer and Status Verification |

EDI 146 | Request for Student Educational Record (Transcript) |

EDI 147 | Response to Request for Student Educational Record (Transcript) |

EDI 188 | Educational Course Inventory |

EDI 189 | Application for Admission to Educational Institutions |

EDI 190 | Student Enrollment Verification |

EDI 191 | Student Loan Pre-Claims and Claims |

EDI 194 | Grant or Assistance Application |

EDI X12 Transaction Number | EDI Transaction Name / Document Type |

EDI 248 | Account Assignment/Inquiry and Service/Status |

Invoice | |

EDI 811 | Consolidated Service Invoice/Statement |

EDI 812 | Credit/Debit Adjustment |

EDI 818 | Commission Sales Report |

EDI 819 | Operating Expense Statement |

Payment Order/Remittance Advice | |

EDI 821 | Financial Information Reporting |

EDI 822 | Account Analysis |

EDI 823 | Lockbox |

EDI 824 | Application Advice |

EDI 827 | Financial Return Notice |

EDI 828 | Debit Authorization |

EDI 829 | Payment Cancellation Request |

EDI 831 | Application Control Totals |

EDI 859 | Freight Invoice |

EDI 980 | Functional Group Totals |

EDI X12 Transaction Number | EDI Transaction Name / Document Type |

EDI 197 | Real Estate Title Evidence |

EDI 198 | Loan Verification Information |

EDI 199 | Real Estate Settlement Information |

EDI 200 | Mortgage Credit Report |

EDI 201 | Residential Loan Application |

EDI 202 | Secondary Mortgage Market Loan Delivery |

EDI 203 | Secondary Mortgage Market Investor Report |

EDI 205 | Mortgage Note |

EDI 206 | Real Estate Inspection |

EDI 260 | Application for Mortgage Insurance Benefits |

EDI 261 | Real Estate Information Request |

EDI 262 | Real Estate Information Report |

EDI 263 | Residential Mortgage Insurance Application Response |

EDI 264 | Mortgage Loan Default Status |

EDI 265 | Real Estate Title Insurance Services Order |

EDI 266 | Mortgage or Property Record Change Notification |

EDI 833 | Mortgage Credit Report Order |

EDI 872 | Residential Mortgage Insurance Application |

EDI X12 Transaction Number | EDI Transaction Name / Document Type |

EDI 100 | Insurance Plan Description |

EDI 112 | Property Damage Report |

EDI 148 | Report of Injury, Illness or Incident |

EDI 186 | Insurance Underwriting Requirements Reporting |

EDI 252 | Insurance Producer Administration |

EDI 255 | Underwriting Information Services |

EDI 267 | Individual Life, Annuity and Disability Application |

EDI 268 | Annuity Activity |

EDI 270 | Eligibility, Coverage or Benefit Inquiry |

EDI 271 | Eligibility, Coverage or Benefit Information |

EDI 272 | Property and Casualty Loss Notification |

EDI 273 | Insurance/Annuity Application Status |

EDI 274 | Health Care Provider Information |

EDI 275 | Patient Information |

EDI 276 | Health Care Claim Status Request |

EDI 277 | Health Care Claim Status Notification |

EDI 278 | Health Care Services Insurance/Benefit Review Information |

EDI 288 | Health Care Services Insurance/Benefit Review Information |

EDI 362 | Cargo Insurance Advice of Shipment |

EDI 500 | Medical Event Reporting |

EDI 820 | Premium Payments |

EDI 834 | Benefit Enrollment and Maintenance |

EDI 835 | Health Care Claim Payment/Advice |

EDI 837 | Health Care Claim |

EDI 924 | Loss or Damage Claim – Motor Vehicle |

EDI 925 | Claim Tracer |

EDI 926 | Claim Status Report and Tracer Reply |

EDI 928 | Automotive Inspection Detail |

Ready to find out more about Commport EDI Solutions For Financial Industry

Need Help? Download: EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI in the finance industry helps businesses, financial institutes, and governments with the seamless transmission of financial information

Payment automation, Highly secure & reduce errors, Improve cash flow, Reduce data processing cost.

Yes, EDI is designed with robust security measures, including encryption and secure communication protocols. This ensures the secure transmission of sensitive financial data, meeting the stringent security requirements of the finance industry.

Yes, EDI can be seamlessly integrated with existing financial systems and software. It is designed to interface with various financial platforms, allowing for compatibility and streamlined data exchange.

EDI contributes to compliance by ensuring standardized and accurate data exchange, aligning with regulatory requirements in the finance industry. It enables financial institutions to adhere to reporting standards and swiftly adapt to changing regulatory landscapes.